Dear Premium Members:

This month I want to profile the popular

tax sale investing state of Arizona. Tax lien certificate sales are

occurring right now, online, in four counties, and the remaining

counties will hold their tax sales in February.

Maricopa County, Arizona

January 17 – February 7, 2011

http://treasurer.maricopa.gov/research/faq_lien.htm

Auction website:

https://www.bidmaricopa.com

Yavapai County, Arizona

January 18 – February 8, 2011

http://www.co.yavapai.az.us/BackTaxSale.aspx

Auction website:

https://www.yavapaitaxsale.com

Apache County, Arizona

January 28 – February 17, 2011

https://www.bidapachecounty.com

Coconino County, Arizona

January 28 – February 17, 2011

http://www.coconino.az.gov/treasurer.aspx?id=548

Auction website:

https://www.coconinotaxsale.com

Visit

http://www.rogueinvestor.com/Tax_Sale_Calendar.pdf

for our recently revised tax sale calendar (password = taxsales).

In

Arizona, the state-mandated interest rate on certificates is 16

percent, so this is where the bidding begins (the winning bidder pays

the minimum bid and accepts the lowest interest rate). There is a

three-year redemption period; but the property owner also is allowed to

redeem any time after this period but before a Treasurer's deed is

delivered to the certificate holder who forecloses on the property.

The

following is a discussion of the tax lien sale process in Arizona.

It will be followed by a screen of the Yavapai County tax sale list.

ARIZONA TAX LIEN SALES

General

Information

Governing State

Law:

Arizona Revised Statutes, Title 42 – Taxation, Chapter 18 – Collection

and Enforcement, Article 3 – Sale of Tax Lien for Delinquent Taxes, and

Article 4 – Redemption of Tax Liens and Article 5 – Judicial

Foreclosure of Right of Redemption, and Article 6 – Administrative

Foreclosure of Right of Redemption

State Statute:

http://www.azleg.gov/ArizonaRevisedStatutes.asp?Title=42

County Agency

Conducting the Sales: County Treasurer

Private

Administrators of Sales: Yes: Realauction (

http://www.realauction.com) and

Grant Street Group (

http://www.grantstreet.com/revenue_collection/lienauction)

Sale Date:

The tax lien sale must be held in February. The sale continues from day

to day, Sundays and holidays excluded, until the tax lien on each

parcel has been sold. (ARS 42-18112[A] and [B]. Some online sales begin

in January and end in February.

Public or Internet:

Both.

Interest Rate:

16 percent (ARS 42-18114 and 42-18053). The lien bears interest at the

bid rate from the first day of the month following the purchase of the

tax lien (ARS 42-181140).

Redemption Period:

The lien may be redeemed at any time within three years after the date

of the sale; or after three years but before the delivery of a

treasurer's deed to the purchaser or the purchaser's heirs or assigns.

(ARS 42-18152)

Before

the Sale

Obtaining the Tax

Sale List:

The list is posted near the outer door of the office of the County

Treasurer for at least two weeks before the date of the sale. The list

is also published at least one time in a newspaper of general

circulation in the county. The publication must be at least two weeks

but not more than three weeks before the date of sale. The newspaper

that prints the list must also post the list from the first publication

date through March 1 of the current year on the internet on a web site

that posts the legal notices of ten or more Arizona newspapers. (ARS

42-18109[A] – [C]) For most counties, the list is also published on the

County Treasurer’s website.

Registration:

Most counties require a good faith deposit equal to a percentage of the

total dollar amount of liens the bidder anticipates winning.

For

example: If a bidder anticipates winning $100,000 in tax lien

certificates and if that county requires a 10% deposit, he/she must

deposit $10,000 with the Treasurer.

Special Note:

Realauction hosts live training classes via the Internet every Friday

while the Arizona auctions are live. Site Guided Tours are available at

their practice site at www.arizonataxsale.com. A new practice auction

runs every day. Visit

https://www.arizonataxsale.com/training

for more information.

At

the Sale

Minimum Bid:

The minimum bid is the total amount of all unpaid taxes that are

delinquent on the property, together with all penalties, interest and

charges due for the current or preceding years (ARS 42-18104 and

42-18107).

Bidding Process:

The winning bidder is the person who pays the whole amount of

delinquent taxes, interest, penalties and charges due on the property,

and who in addition offers to accept the lowest rate of interest on the

amount paid to redeem the property from the sale (ARS 42-18114).

Payment:

The purchaser of a tax lien is required to pay the purchase price in

cash at the time of sale (ARS 42-18116[A]). Payment methods vary for

each county. Generally, deposits and payments may be made via ACH

(electronic check), wire transfer, cash, cashier’s check, or money

order. The purchaser also must pay a processing fee of not more than

$10 per tax lien (ARS 42-116[C]). If the purchaser fails to pay and the

Treasurer cannot resale the lien or the sale is closed, the Treasurer

can either advertise the lien specially, or recover the amount bid by

civil action in a court of competent jurisdiction (ARS 42-18116[B]).

If

because of an erroneous sale a real property tax lien is sold on

property on which no tax is due, the County Treasurer must hold the

purchaser harmless by paying the purchaser the amount of the principal

and interest at the rate bid and endorsed on the certificate of

purchase or 10 percent per year simple, whichever is less (ARS

42-118125).

Evidence of

Successful Bid:

The County Treasurer will deliver a certificate of purchase to the

purchaser at the sale for delinquent taxes. Alternatively, the

Treasurer may provide for a registered certificate in the Treasurer's

records. (ARS 42-18118[A]). The purchaser must pay a fee of $10 per

certificate (ARS 42-18118[D). Most counties today do not issue paper

certificates. The certificate is kept as an electronic file at the

treasurer’s office. A description of the information contained on a

certificate is provided by ARS 42-18118(B).

Unsold Tax Lien

Certificates:

Unsold liens are assigned (“struck off”) by the County Treasurer to the

state for the amount of the taxes, interest, penalties and charges, and

a certificate of purchase is issued for each such lien.

These

certificates are available for purchase by visiting the Treasurer's

office or website once the auction is closed and balanced. These

certificates bear an interest rate of 16 percent per year simple, with

a fraction of a month counting as a whole month (ARS 42-18053[A]) and

42-18113[B][2]).

After

the Sale

Paying Subsequent

Taxes:

On or after June 1, if a person who holds a certificate of purchase

wants to pay subsequent taxes, accrued interest and related fees due on

the property (i.e., after the second half taxes have become delinquent

but before they go to auction), the person must present the certificate

or receipt of registered certificate to the County Treasurer. The

Treasurer will enter the amount of the payment on the certificate and

on the record of tax lien sales (for a fee of $5). The amount of

subsequent taxes bears interest at the rate stated in the certificate

of purchase from the first day of the month following the purchase of

the subsequent tax lien. (ARS 42-18121)

If a person who

holds a certificate of purchase does not pay the subsequent taxes,

accrued interest and related fees due on the property, the County

Treasurer may require a person who wants to purchase a subsequent

certificate of purchase on the property to acquire by assignment all

currently outstanding certificates of purchase previously issued on the

property. The County Treasurer will process the sale as an assignment

on behalf of the previous holder of the certificate of purchase. Such

an assignment vests in the person all the right and title of the

original purchaser with the lien date effective from the original lien

sale date. (ARS 42-18121.01)

Redemption Amount:

Simple interest accrues on a monthly basis. If the certificate carries

an interest rate of 12%, then interest will accrue at 1% simple

interest every month until the certificate is redeemed.

Process if the

Lien is Redeemed:

When the owner redeems the certificate, he/she will pay the delinquent

taxes, interest, and assorted fees and costs, and a check is sent out

by the County Treasurer with a letter to the certificate holder. (ARS

42-18153[A]) The certificate holder must surrender the certificate of

purchase.

If only a portion of the tax lien on the property

described in the certificate of purchase or the registered certificate

is redeemed, the Treasurer will endorse on the certificate or annotate

the record of the registered certificate the portion redeemed and the

amount of money paid to the person holding the certificate and shall

take a receipt for the money paid. (ARS 42-18155)

Assignment of Tax

Lien Certificate:

The certificate of purchase, whether registered or paper, is assignable

by endorsement. An assignment, when noted on the record of tax lien

sales in County Treasurer’s office, vests in the assignee all the right

and title of the original purchaser. (ARS 42-18118[C])

For

any tax lien assigned to the State, the County Treasurer shall sell,

assign and deliver the certificate of purchase to any person who pays

to the County Treasurer the whole amount due under the certificate,

including interest, penalties and charges, and in addition the entire

amount of subsequent taxes assessed on the property described in the

certificate. The County Treasurer shall collect a fee of not more than

$10 from the assignee for making each assignment. (ARS 42-18-122)

Life Span of Tax

Lien Certificate:

Ten years. If the tax lien is not redeemed and the purchaser or the

purchaser's heirs or assigns fail to commence an action to foreclose

the right of redemption as provided by this chapter within 10 years

after the last day of the month in which the lien was acquired pursuant

to section ARS 42-18114, the certificate of purchase or registered

certificate expires and the lien is void. (ARS 42-18127[A])

At

least thirty but not more than sixty days before the expiration date,

the County Treasurer must notify the purchaser by certified mail of the

pending expiration. Within seven days after expiration, the Treasurer

wil notify the purchaser by certified mail that the lien and

certificate of purchase or registered certificate have expired. (ARS

42-18127[B])

This section does not apply if, at the time of expiration:

- The parcel for which the lien was purchased is

subject to a judicial proceeding or a 30-day notice pursuant to ARS

42-18202.

- Other

applicable law or court order prohibits the commencement of an action

to foreclose the right to redeem. The expiration date of the tax lien

shall be extended to 12 months following the termination of such

prohibition. (ARS 42-18127[D])

I will send you a special

report next week that discusses the method for foreclosing on the

property if the owner does not redeem within the 3-year period.

County

Tax Lien Sales Information

2011 Arizona Tax Lien Sale Links for the Largest Counties

(1) Apache County

http://www.bidapachecounty.com

(Grant Street Group online sale)

http://www.co.apache.az.us/Departments/Treasurer/Treasurer.htm:

see header “Informational Links”

(2) Cochise County

http://cochise.az.gov/cochise_treasurer.aspx?id=52

(3) Coconino County

http://www.coconinotaxsale.com

(Realauction online sale)

http://coconino.az.gov/treasurer.aspx?id=548:

mouse over “Tax Liens”

(4) Maricopa County

https://www.bidmaricopa.com

(Grant Street Group online sale)

http://treasurer.maricopa.gov:

see header “Liens & Research”

(5) Mohave County

http://www.mohavetaxsale.com

(Realauction online sale)

http://www.co.mohave.az.us/ContentPage.aspx?id=132&cid=223

(6) Pima County

http://www.to.pima.gov/tax_lien_sale.html

(public auction)

(7) Pinal County

http://pinalcountyaz.gov/Departments/Treasurer/Pages/TaxLienSale.aspx

(online sale via the Treasurer’s website)

(8) Yavapai County

http://www.yavapaitaxsale.com

(Realauction online sale)

http://www.co.yavapai.az.us/BackTaxSale.aspx

(9) Yuma County

http://www.co.yuma.az.us/index.aspx?page=86

(public auction)

YAVAPAI COUNTY, ARIZONA

EXAMPLE

The

Yavapai County tax lien certificate sale is conducted, for the County

Treasurer, by Realauction.com. This is a privately owned company

specializing in the advertising and sale of delinquent tax certificates

for local governments and municipalities.

Step 1: Background

Information

There

is a great deal of information available online that you should read

before you register for the tax lien sale. First, visit the County

Treasurer's website at http://www.co.yavapai.az.us/Treasurer.aspx.

There is a link "Treasurer's Back Tax Sale" in the left column (http://www.co.yavapai.az.us/BackTaxSale.aspx),

and a link "2011 Tax Lien Sale" or "Online Internet Auction" in the

main body (http://www.yavapaitaxsale.com).

Click on the link for Treasurer's Back Tax Sale and

you'll land on a page with links to all of the following:

- tax liens explained

- 29 frequently asked questions

- assessor book locations map

- 2011 tax sale list in pdf format (139 pages)

- available

tax liens for purchase from previous sales (116 pages - these liens are

available for purchase directly from the county and bear the full 16%

interest rate)

- document with more information

I would even recommend contacting the Treasurer's office to see if you

can find out any information regarding last year's sale.

Click on the link for 2011 Tax Lien Sale and you will be taken to the

official auction website at

http://www.yavapaitaxsale.com.

On that site, be sure to read through the information available by

clicking on the following links:

- Start Here: a discussion of how the sale works

- Bidding Rules

- Preview Items for Sale: the tax sale list

Once you are comfortable that you understand the process, proceed with

registering yourself as a bidder.

Step 2: Register

You only need to register for the sale at the official auction website (

http://www.yavapaitaxsale.com).

There is no additional registration that needs to occur through the

County Treasurer. Click on the link "Register" on the home page of the

official auction website. The site will walk you through the entire

process.

Step 3: Training

For

training information, click on the links "Training General Information"

and "Tax Certificate Process" on the home page of the auction website

at

https://www.yavapaitaxsale.com.

Live "webinar" training classes will be held via the Internet by

Realauction on the dates and times listed on the website at

https://www.yavapaitaxsale.com/training.

The classes last approximately 90 minutes, cover use of the software

only, and are free of charge. Attendance is by registration only. You

will need to contact the Realauction Customer Service Center at

(877) 361-7325 in advance to register.

In addition to the webinar classes, Realauction offers a fully

functional "practice" site at

http://www.arizonataxsale.com

that you can use to familiarize yourself with the online auction

process. The practice auctions are held every day and close at

2:00 PM MT.

From the home page of the practice site (

http://www.arizonataxsale.com),

additional training materials are available by clicking one of the

two "Site Guided Tours" which contain page-by-page instructions on how

to use the site.

You can also call the Realauction Customer Service Center and a

representative will assist you.

Step 4: Tax Sale List

Use the list available

on the official auction website at https://www.yavapaitaxsale.com/view_bids.cfm,

as you will be able to sort the list and it has been populated with

external data.

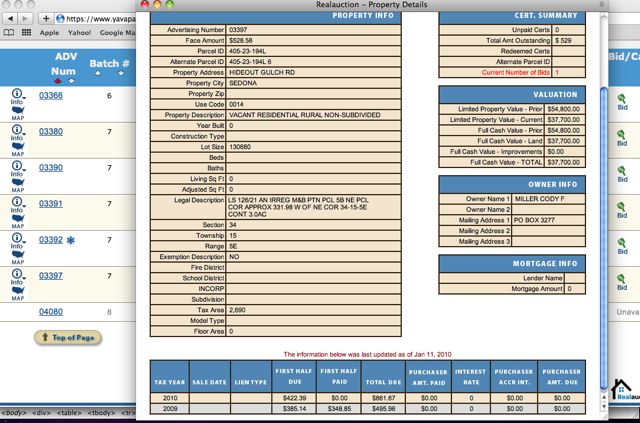

As you can see, for each certificate listed there is an ADV number, a

parcel ID number, a face amount, and a status.

The ADV number is

linked to a page on which the County Treasurer has compiled a lot of

important information for you already:

- Property

Information:

Advertising Number, Face Amount, Parcel ID, Alternate Parcel ID,

Property Address, Property City, Property Zip, Use Code, Property

Description, Year Built, Construction Type, Lot Size, Beds, Baths,

Living Sq Ft, Adjusted Sq Ft, Legal Description, Section, Township,

Range, Exemption Description, Fire District, School District, INCORP,

Subdivision, Tax Area, Model Type and Floor Area

- Certificate

Summary: Unpaid Certs, Total Amt Outstanding, Redeemed

Certs, Alternate Parcel ID, Current Number of Bids

- Valuation:

Limited Property Value - Prior, Limited Property Value - Current,

Full Cash Value - Prior, Full Cash Value - Land, Full Cash Value -

Improvements, Full Cash Value - TOTAL

- Owner

Information: Owner Name 1, Owner Name 2, Mailing Address

1, Mailing Address 2, Mailing Address 3

- Mortgage

Information: Lender Name, Mortgage Amount

- Outstanding

Taxes:

Tax Year, Sale Date, Lien Type, First Half Due, First Half Paid, Total

Due, Purchaser Amt. Paid, Interest Rate, Purchaser Accr. Int.,

Purchaser Amt. Due

Pay special attention to any blue icons to

the right of the ADV number column. For example, an asterisk is used to

indicate parcels that have prior tax years due or an existing lien, but

because of unpaid subsequent taxes they are going back into sale this

year. If you purchase one of these parcels with a prior lien or prior

year you are required to buy out the prior lien as well as the current

lien.

A "P" icon refers to possessory rights parcels that

are strictly improvements on the land. In the case of possessory rights

and utility company parcels, the County Treasurer asks you to be very

careful and have a complete understanding of what you are bidding on

before you bid.

As part of your due diligence, you should visit the U.S. Bankruptcy Court for the District of

Arizona at

http://www.azb.uscourts.gov. Under

the header "Online Services," click on the link "U.S. Party/Case

Index." This takes you to an electronic public access service at

https://pacer.login.uscourts.gov/cgi-bin/login.pl?court_id=00idx

that allows users to obtain case and docket information from federal

appellate, district and bankruptcy courts.

The Parcel ID number

is linked to an interactive map that gives you additional information

on the owner, parcel, improvements, assessment, taxes and recent sale

information on the RESULTS tab. Be sure to look at the MAP LAYERS and

SEARCH tabs as well.

The Face Amount is

the minimum bid for the certificate. You can sort by ascending or

descending values.

Finally,

the Status column

lets you know whether the certificate is still available for sale.

Again, you can sort by ascending or descending.

Step

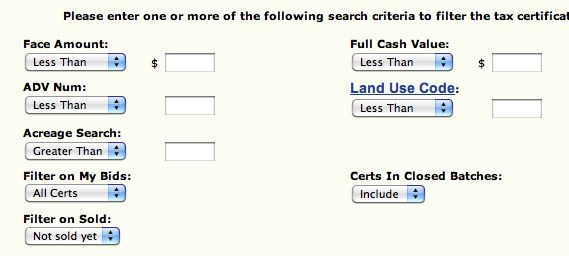

5: Screen the List

Let's start by looking at the entire list. Go to the quick search

feature and do not type anything in the search and you will pull up the

entire range of possibilities - over 4900 liens ranging from a ranch

lot

with taxes owed of $35.27 to a health club with a whopping tax bill of $67,677.60.

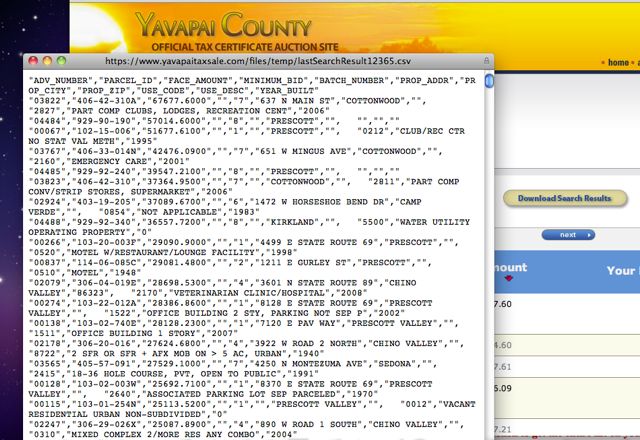

Now, let's use the export

function to get the entire list on your computer.

Go to the download search results button. Click on the button and you

will generate a file called a .csv file. Save this file to your

computer and open it with Excel, Open Office or any spreadsheet or

datbase program. CSV files are comma-separated files designed to be

read by these programs.

You now have the entire list, which you can easily manipulate by using

the sort features of Excel.

Why bother doing this you might ask?

One reason is that I like to look at the entire list in spreadsheet

format and see what it has to offer without clicking on each link.

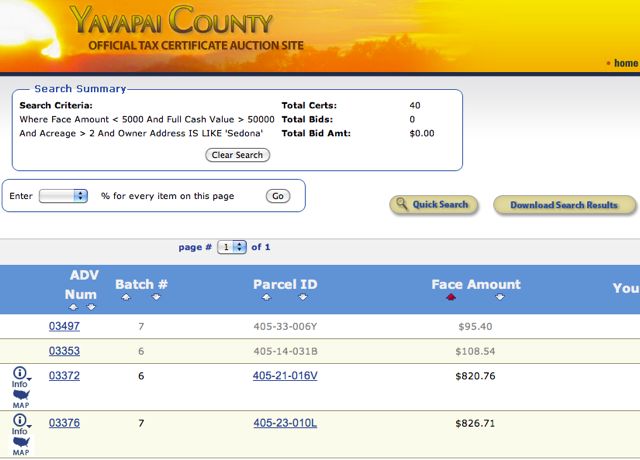

Now, having said that, let's go back to the Real Auction system and try

another search that is often overlooked. Go back to the quick search

feature and go down to City. Using only city, you can refer back to

your spreadsheet list and decide on a city, such as Sedona, Prescott or

Chino Valley. This is a location screen.

For example, try Sedona.

Using the location screen, you can now screen by the face value of the

lien and the value of the property.

Try a face value less than $5000 and a property value of greater than

$50000.

Once you have completed the screen, you should have something a little

more manageable, but my list is still 200 liens.

So, it's time to look at the property type. This is personal choice,

but I like land and in Sedona that's a valuable commodity. Let's try

a search of acreage greater than 1.0 acre. That should screen out most

small lots and leave larger pieces of land.

You may choose residential properties, duplexes, commercial, etc. Use

the drop down land use codes and if you only want to search one

property type, search, for example, between 11 and 11 and you will only pull up that type.

This leaves my list at 40; however, about half of these are

unavailable, meaning they have been redeemed and pulled from the list.

It looks like my final list is about 17, which is something I can

handle.

Okay, here is a parcel, I might be interested in. It is in Sedona, but

land only. It currently has only one bid. It is a recent tax lien with

no outstanding liens and it is larger than 2 acres in size. The full

cash value is approximately $40000 and the taxes owed is about $770.

Chances are the winning interest rate will be above 10%, maybe even 14

to 16%. If it is not redeemed, I can buy next years's taxes for

about $770 and the following year's taxes for the same amount. In the

end, assuming it is never redeemed and I have to pay 3 years of taxes,

plus legal and/or title fees to foreclose and clear the title, I am

into the property for about $4000 to $5000. To be conservative, double

that and assume I have to hold it for three more years. My total

investment is $8000 to $10000 and I can sell it for $40,000 assuming no

additional appreciation, which would just about cover realtor fees

anyway.

The question is, "Would you give me $10,000 if I gave you $40,000?"

That is the tax lien game in a nutshell.

The downside is earning the interest rate at 10% to 16%.

When you are ready to place a bid, place your minimum bid amount, which

is the minimum percentage you are willing to bid. For example, you

could place a bid of 7% and if you are the lowest and the other bids

are 16%, 14% and 12%, you would win the bid at 11% even though you bid

7%. This is called proxy bidding.

Wishing you the best,

Michael