Dear Premium Members:

This month I want to profile the little known

tax lien investing state of Nebraska. By state law,counties must

start their tax lien certificate sale on the first Monday in March.

Douglas County is holding its sale online. Here are links to tax sale

information for some other counties that are holding public auctions:

Adams County, NebraskaMarch 7, 2011

http://www.adamscounty.org/treasurer/tax_sales.htm Buffalo County, NebraskaMarch 7, 2011

http://www.buffalocounty.ne.gov/offices/Treasurerhttp://www.buffalocounty.ne.gov/offices/Treasurer/PDF/20110204Advertising.pdf Douglas County, NebraskaFebruary 3 - March 7, 2011

https://www.douglastaxsale.com Hall County, NebraskaMarch 7, 2011

http://www.hallcountyne.gov/content.lasso?page=7451&-session=hcv:4C5C891C0565f19C2Fthqny49F9CLancaster County, NebraskaMarch 7, 2011

http://lancaster.ne.gov/treasurer/pdf/ts_info.pdfhttp://lancaster.ne.gov/treasurer/pdf/ts_prereg.pdf http://www.irs.gov/pub/irs-pdf/fw9.pdfSarpy County, NebraskaMarch 7, 2011

http://www.sarpy.com/taxsalehttp://www.sarpy.com/treasurer/documents/Del2011list.pdf

If you are interested in a different county, vist

http://www.naco.org,

mouse over "About Counties" and click on "Find a County," and then

click on the state of Nebraska. Click on the county you are interested

in, and then on the county link provided on the next page. Once you are

on the county's website, look for a link to the Treasurer, which is

usually under a header such as department, elected officials or

government.

Visit

http://www.rogueinvestor.com/Tax_Sale_Calendar.pdf

for our recently revised tax sale calendar (password = taxsales).

In Nebraska, the state-mandated interest rate on certificates is 14

percent. Bids are entered with the certificate going to the bidder

willing to pay the delinquent taxes for smallest ownership portion of

the property in the event the property is foreclosed. Simple interest

accrues at an interest rate of 14 percent annually or .039 percent

every day. Three years from the date of the tax auction but

no longer than three years and six months from the auction, the tax

certificate holder can begin the foreclosure process against the

property. Failure to do so within the allotted time will result in the

tax certificate becoming worthless.

The

following is a discussion of the tax lien sale process in Nebraska.

It will be followed by a screen of the Douglas County tax sale list.

NEBRASKA TAX

LIEN SALES

General

Information

Governing

State

Law: Nebraska Revised Statutes (NRS), Chapter 77: Revenue and Taxation, Section 18 (NRS 77-1801 through 77-1863)

State

Statute:

http://nebraskalegislature.gov/laws/browse-chapters.php?chapter=77

County

Agency

Conducting the Sales: County Treasurer

Private

Administrators of Sales: Yes: Realauction (

http://www.realauction.com)

Sale

Date: The sale

must start on or after the first Monday in March. (NRS 77-1801)

Typically, counties hold their tax sale on the first Monday in

March.

Public

or Internet:

Both.

Interest

Rate: Simple interest accrues at an interest rate of 14 percent annually or .039 percent every day.

Redemption

Period:

The lien may be redeemed at any time within three years after the date

of the sale; and no longer than three years and six months after the date of the sale.

Before

the Sale

Obtaining

the Tax

Sale List:

The tax lien list is published in a newspaper once a week for three

consecutive weeks beginning the first week in February. In many

counties, the list is available on the County Treasurer's website.

Registration:

It is common policy throughout the state of Nebraska that bidders must

be separate and distinct bidders. Bidders who register as basically the

same entity will be disallowed and only one representative will be

allowed to participate.

Most counties will require a good faith deposit equal to a

percentage of the total dollar amount of liens the bidder anticipates

winning. For example, if a bidder anticipates winning $100,000 in tax

lien certificates and if that county requires a 10 percent deposit, the

bidder must deposit $10,000 with the Treasurer.

Some

counties do not require a deposit. Instead, the bidder creates a

“budget” based on the total amount they want to invest in that auction.

The budget must be created before bids can be placed. The budget will

limit how much a bidder can win no matter how many bids are placed.

Some counties allow bidders to create a budget for each batch.

At

the Sale

Minimum

Bid: The total amount of unpaid real estate taxes, assessments, penalties, advertising costs and fees.

Bidding

Process:

The winning bidder is the person willing to pay the delinquent

taxes for smallest ownership portion of the property in the event the

property is foreclosed.

If

any person present at the sale states they want to bid down potential

ownership of a given parcel of real estate, the county will hold a bid

down auction. The person who offers to pay all the taxes due on any

real property for the smallest portion of the same shall be the

purchaser, and when such person designates the smallest portion of the

real property for which he or she will pay the amount of taxes assessed

against any such property, the portion so designated is considered an

undivided portion. The smallest bid accepted is zero percent.

If

no person makes a request to bid down on any parcel, the sale is

conducted as a round robin (used extensively in Nebraska), with 100%

undivided interest implied. If the sale goes to round robin, and a

bidder's randomly assigned number is chosen, he may choose to accept

that parcel which is offered to him in the round robin or pass. If the

bidder chooses to pass, he passes to the next chair, and so on. The

bidder's turn in that round is done until the County Treasurer goes

around the whole room of bidders. If the county proceeds in this

manner, and someone announces their desire to bid a parcel down, then

the parcel will be bid down.

Payment: Payment

methods vary for each county. Generally, deposits and payments may be

made via ACH (electronic check), wire transfer, cash, cashier’s check,

or money order are accepted.

Evidence

of

Successful Bid:

The successful bidder will receive a certificate in writing, describing

the real property purchased, the sum paid, and the time when the

purchaser will be entitled to a deed. The certificate will be signed by

the County Treasurer. (NRS 77-1818; see 77-1819 for the form the

certificate will appear as.)

Unsold

Tax Lien

Certificates:

Certificates issued for tax liens that were not sold during the auction

are struck to the County and become available for purchase at the

Treasurer's office once the auction is closed and balanced. (NRS 77-1814)

After

the Sale

Paying

Subsequent

Taxes:

If taxes subsequently become delinquent again, the certificate holder

may pay those and add the amount of the payment to the current

certificate. Those funds earn interest from that moment on.

Redemption

Amount:

14 percent from the date of the sale. Redemption may occur at any time

before the delivery of tax deed by the County Treasurer by paying the

sum mentioned in the certificate, with interest from the date of

purchase to the date of redemption, together with all other taxes

subsequently paid, whether for any year or years previous or subsequent

to the sale, and interest at the same rate from the date of such

payment to the date of redemption. (NRS 77-1824)

Process

if the

Lien is Redeemed:

The County Treasurer will send written notice of redemption, by

registered or certified mail, to the holder of the certificate of

tax sale at the address on file with the County Treasurer. The

redemption money will be paid to or upon the order of the holder on

return of the certificate. (NRS 77-1825)

Assignment

of Tax

Lien Certificate:

The certificate can be sold and transferred (for $10) to another name.

An assignment vests in the assignee, or his or her legal

representatives, all the right and title of the original purchaser.

(NRS 77-1822)

Foreclosing:

Three years from the date of the delinquent tax auction but no

longer than three years and six months from the auction, the

tax certificate holder can begin the foreclosure process against the

property. Failure to do so within the allotted time will result in the

tax certificate becoming worthless. (NRS 77-1856)

According

to author Jamaine Burrell, as quoted on the Sarpy County Treasurer's

website, if you are a winning bidder at less than 100% ownership

interest, a Treasurer’s deed allows both the bidder and the original

owner to hold tenancy-in-common interest in the property. The bidder

holds interest at the percentage that he or she bid at auction and the

original owner holds the remaining percentage of interest in the

property. For example, if a winning bidder purchases a tax lien

certificate for 85 percent interest in the securing property. Upon

foreclosure, the tax lien certificate holder owns 85 percent of the

property, and the original property owner owns15 percent. The two

parties become tenants-in-common. Competitive bidding down for

tenancy-in-common ownership provides an opportunity for the original

property owner to retain partial ownership in the property and also to

control the disposition of the property. The original property owner’s

percentage of the tenancy-in-common, however small,

restricts the

new partial owner from selling or financing the property. For either

party of the tenancy-in-common to sell or secure financing against the

property, both parties must agree to the action or initiate a partition

action, which is a request to the courts to sell the property and split

the proceeds from the sale in proportion to each party’s percentage of

interest.

There are statutory time lines for both

foreclosures and deeds, and if they are not met according to these

statutes, you could lose your entire investment. Statutory requirements

include notification timelines that must

be met prior to three and one-half years. Many

County Treasurers recommend hiring an attorney. The Sarpy County

Treasurer's website notes that fees for foreclosure have been quoted at

$750 and up. If a foreclosure is filed, you are required to notify the

County Treasurer of the court case. You area also required to send a

copy of the dismissal of the case when this occurs.

DOUGLAS COUNTY, NEBRASKA

EXAMPLE

The

Douglas County tax lien certificate sale is conducted, for the County

Treasurer, by Realauction.com. This is a privately owned company

specializing in the advertising and sale of delinquent tax certificates

for local governments and municipalities. Last month's special report

featured a tax lien sale also conducted by this company (Yavapai

County, Arizona).

Important Dates

February 3, 2011 = auction begins

March 3, 2011 at 4:00 p.m. CT = deadline for deposit (deposit requirement is 10% of your intended investment)

March 7, 2011 at 5:00 p.m. CT = auction ends

March 9, 2011 at 2:00 p.m. CT = payment deadline

Important Note: In

all previous Douglas County tax certificate auctions, liens have

been sold at 100 percent ownership. Ownership of less than 100 percent

raises questions concerning title insurance and foreclosure rights, so

be sure you know your rights before placing bids at less than 100

percent

ownership.

Important Websites

Douglas County: http://www.douglascounty-ne.gov

Douglas County Treasurer: http://www.dctreasurer.org

Douglas County Property Assessor: http://www.dcassessor.org

Douglas County Clerk of the District Court: http://clerk.dc4dc.com

Nebraska Government: http://www.state.ne.us

Step 1:

Background

Information

There

is a great deal of information available online that you should read

before you register for the tax lien sale. First, visit the

County

Treasurer's website at http://www.dctreasurer.org. There is a link in the left-hand column for "Tax Lien Sale," which takes you directly to the auction website at https://www.douglastaxsale.com.

The County Treasurer does not provide any information about the sale on

its website, but you may want to contact the Treasurer's office to see

if you

can find out any information regarding last year's sale. Contact

information is as follows:

Telephone Numbers

Administration: (402) 444-7082

Information: (402) 444-7103

Email

Treasurer@dctreasurer.org

Once you are on the auction website at https://www.douglastaxsale.com, read through the information available by

clicking on the following links:

- Start Here: a discussion of how the sale works

- Bidding Rules: mandatory reading for first time Nebraska tax certificate bidders

- Preview Items for Sale: the list of certificates currently up for auction

Once you are comfortable that you understand the process, proceed with

registering yourself as a bidder.

Step 2:

Register

You only need to register for the sale at the official auction website.

There is no additional registration that needs to occur through the

County Treasurer. Click on the link "Register" on the home page of the

official auction website. The site (

https://www.douglastaxsale.com/form2.cfm) will walk you through the entire

process.

Step 3:

Training

For

training information, click on the links "Training General Information"

and "Tax Certificate Process" on the home page of the auction website

at

https://www.douglastaxsale.com.

Live "webinar" training classes will be held via the Internet by

Realauction on the dates and times listed on the website at https://www.douglastaxsale.com/training.

The classes last approximately 90 minutes, cover use of the software

only, and are free of charge. Attendance is by registration only. You

will need to contact the Realauction Customer Service Center

at

(877) 361-7325 in advance to register. The next and last bidder

training webinar is this Friday, February 25, 2011, at 9:00 a.m. CT

(10:00 a.m. ET).

In addition to the webinar classes, Realauction offers a fully

functional "practice" site at

http://www.arizonataxsale.com

that you can use to familiarize yourself with the online auction

process. The practice auctions are held every day and close

at

2:00 p.m. MT.

From the home page of the practice site (

http://www.arizonataxsale.com),

additional training materials are available by clicking one of

the

two "Site Guided Tours" which contain page-by-page instructions on how

to use the site.

You can also call the Realauction Customer Service Center and a

representative will assist you.

Step

4: Tax Sale List

The tax lien list is available on the official auction website at https://www.douglastaxsale.com/view_bids.cfm (click on "Preview Items for Sale"). You will be able to sort the list and it has been populated with

external data. The list is 156 pages long.

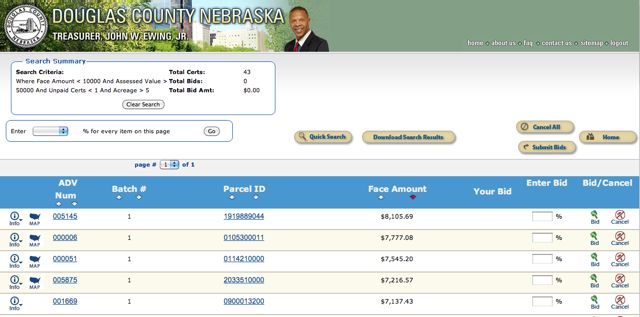

As you can see, for each certificate listed there is an ADV number, a

parcel ID number, a face amount, and a status.

The ADV number

is

linked to a page on which the County Treasurer has compiled a lot of

important information for you already:

- Property

Information:

Advertising Number, Face Amount, Parcel ID, Alternate Parcel ID,

Property Address, Property City, Property Zip, Use Code, Use

Description, Year Built, Construction Type, Lot Size, Acres, Beds, Baths,

Living Sq Ft, Adjusted Sq Ft, Legal Description, Sale Date, Sale Price, Gross Sq Ft, Section, Township, Range, and Tax Area

- Certificate

Summary: Unpaid Certs, Past Years Outstanding, Redeemed Certs, Current Number of Bids

- Valuation: Homestead Amount, Building Value, Land Value, Total Value

- Owner

Information: Owner Name 1, Owner Name 2, Mailing Address

1, Mailing Address 2, Mailing Address 3, Mailing City, Mailing State, Mailing Zip Code

- Data from 2010 Tax Roll:

Cert Year, Cert Number, Status Type, Buyer Number, Tax Deed Info,

Notes, Original Sale Date, Days Open, Original Face Amount, Bid Int.

Pay special attention to any blue icons to

the right of the ADV number column. Be sure to click on the icon and read the accompany information.

The Parcel ID

number

is linked to a page that provides the following useful information:

- property information (key number, account type, parcel number, parcel address, legal description

- value information for several tax years (land, improvement, total)

- show all transactions: sales date, book number, page number, sale price, grantor, grantee, 521 link

- land information: acres, square feet, units, depth, width, vacant status

- Google map

- link to interactive GIS map

- link to Treasurer's tax report: taxpayer mailing address, property information, tax information for 2010, tax payment history

- link to print report

The Face

Amount is

the minimum bid for the certificate. You can sort by ascending or

descending values.

Finally, the Status column

lets you know whether the certificate is active (i.e., available for sale) or unavailable.

Again, you can sort by ascending or descending.

Step

5: Screen the List

Using

the Quick Search, set up your criteria based upon residential

searches, minimum tax lien amount, value, acreage or even city.

Example: If you want to search

for residential properties, you can set up a search criterion of

between 3400 and 3600 for the land use codes.

If you want to search for properties with more than 3 acres, use the acreage greater than search.

Come up with your own criteria, then click on the property links to determine what the underlying lien is worth.

I like land. This is a personal preference. So I set up a search of

more than 5 acres, one year of taxes owed (recent liens), value greater

than $50,000 and the face amount of the lien less than $10,000.

The result is 43 potential liens. More than enough to get started.

Next, I like to arrange the liens based in order of Face Amount by

clicking on the the ascend or descend arrows. Now, earch Parcel I.D. is

linked to a file for more information and the link for the ADV number

will also tell you how many others are bidding. Finally, there are maps

presented to help you locate your lien of interest.

Also, note the Download Results link. This will allow you to download a

CSV file, which is a file that will load into Excel. If you are

technically savvy, try downloading the CSV (comma-delimited) file and

run your searches on Excel.

When you are ready to bid, you will enter a bid based upon the

percentage you are willing to accept. If you bid 100%, which is the

norm, and everyone else bids 100%, then you will be part of the random

bid selection. Otherwise, you can bid a percent ownership, which is

more complicated.

Let's say you are aggressive and decide to bid the lowest percentage

possible, which is 1%. If you are the winning bidder, you will still

earn 14% if and when the lien is redeemed. If the lien is not redeemed,

you will have a difficult time foreclosing on your ownership.

Ultimately, you can force your lien of 1%, but not foreclose on

ownership. It sounds like a great time to read the laws or look at our

CD of tax sale laws.

The point is if you plan on bidding lower than 100%, then you better

make sure it is a lien that will be redeemed; otherwise, it could be

years of waiting and a lot of legal fees.

Assignment: Find the lien priced at less than $200 on a property worth

more than $1,000,000. Do you recognize the owner? Who is it?

Wishing you the best,

Michael