Florida Internet Tax Lien Sales

Hello Premium

Members. Welcome to Internet tax lien auctions in Florida. Florida

is an amazing tax lien state. Here you get to experience the full

range of tax liens, tax deeds, over-the counter tax liens and

over-the-counter tax deeds. Tax Sale Dates: Florida statutes require tax lien certificate sales on or before June 1

of each year. Therefore, most sales are in May and some are actually on

June 1. With the recent Internet auctions, many sales start in May and

end on June 1. Interest Rate:

Interest on a tax lien certificate starts at 18% and is bid down during

the auction in 1/4% increments to as low as 1/4% or even 0%. Any bid

between 1/4% and 18% is guaranteed a 5% fee regardless of when the

certificate is redeemed. When I used to attend live events in Florida,

bidders would yell "one-quarter" or just "quarter" meaning they were

willing to bid all the way down to 1/4% interest knowing they would be

guaranteed at least 5%. This works well if the lien is redeemed in a

month or two, but not as well if it is redeemed right before the end of

the redemption period 23 months later. If the bidder chooses to bid

down to zero percent interest, the bidder will not earn the minimum 5%.

Tax Lien Sales: To find information on tax lien sales, you will need to contact the Tax Collector's Office. Redemption Period: 2 years. Minimum Bid: The amount of taxes, fees and penalties owed. Subsequent Taxes:

During the period between the tax sale date and the expiration of the

redemption period and prior to the issuance of a deed, the certificate

holder may pay all taxes, assessments, penalties and costs due for the

property. Immediately upon paying for any of these additional costs,

the certificate holder should report the payments to the Tax

Collector's Office with the receipts to record them. The certificate

holder can be reimbursed for those taxes. Over-the-Counter Tax Lien Sales:

Certificates not sold at the tax lien sale are “struck off” to the

county. After the tax sale is closed and balanced, these county-held

certificates can be purchased in the Tax Collector’s Office.

Certificates may be purchased by mail or in person, on a first-come,

first-serve basis, at the maximum interest rate of 18 percent. The best

time to purchase is in early to mid June, right after the sales. Tax Deed Sales: If the tax certificate is not redeemed, the certificate holder

cannot institute foreclosure and receive the deed; rather, a public

deed sale must occur. The tax deed is sold to the highest bidder. If

the tax lien holder is not the highest bidder at the tax deed sale,

he/she will receive their investment back with interest. Tax

deed sales are handled by the Clerk of Circuit Court in most counties.

Application for a tax deed sale is made at the Tax Collector’s Office.

There is no extended right of redemption following the tax deed sale.

Tax deed sales are held throughout the year. Some counties hold tax

deed sales every week. Homestead properties are sold for a minimum bid

of one half of their assessed value. Over-the-Counter Tax Deed Sales:

A property that does not sell at the tax deed sale is placed on the

"List of Lands Available for Taxes." After 90 days from the sale date,

anyone can purchase property off the "List of Lands Available for

Taxes." These sales are handled by the Clerk of Circuit Court in most

counties. Other Restrictions:

Florida also has some restrictions regarding the number of lots an individual

investor can own without being registered as a developer. An individual who is

not a developer is allowed to buy a tax deed for only one lot in a planned

subdivision for the purpose of resale (section 498.025[1a], Florida Statutes). A

seller of lots in property subdivided or proposed to be subdivided into 50 lots

or more is required to be registered with the Department of Business and

Professional Regulation, Division of Florida Land Sales, Condominiums, and

Mobile Homes. Also, if a certificate holder purchases 5 certificates in

subdivision that contains 25 or more lots, and eventually obtains 5 tax deeds, he would

be subject to the provisions of section 498.022, Florida Statutes,

regarding standards for transacting land sales. Therefore, it is

recommended that when purchasing certificates on lots or parcels in a

subdivision, the Department of Business and Professional Regulation,

Division of Florida Land Sales, Condominiums, and Mobile Homes be

contacted at (850) 488-1631. A listing of Florida tax

collectors by county is available on the Florida Tax Collectors

website: http://floridataxcollectors.com. Internet Auctions: Real Auction operates Internet auctions for over 25 counties in Florida. Real Auction and the Lee County,

FL

Tax Lien Certificate Sale

Step 1: Visit the Real Auction Website

Sign up with Real Auction and obtain a username and password:

http://www.realauction.com.

Click on the link for "County Tax Certificate Auctions" in the

left-hand column of the webpage.

You have the following counties to select from:

Alachua County -

http://www.alachuataxsale.com - OPENS 5/13/2010

Brevard County -

http://www.brevardtaxsale.com - OPENS 5/13/2010

Columbia County -

http://www.columbiataxsale.com - OPENS 5/6/2010

Duval County -

http://www.duvaltaxsale.com - OPENS 5/11/2010

Escambia County -

http://www.escambiataxsale.com - OPENS 5/6/2010

Flagler County -

http://www.flaglertaxsale.com - OPENS 5/5/2010

Gadsden County -

http://www.gadsdentaxsale.com - OPENS 5/13/2010

Gilchrist County -

http://www.gilchristtaxsale.com - OPENS 5/12/2010

Hendry County -

http://www.hendrytaxsale.com - OPENS 5/13/2010

Hernando County -

http://www.hernandotaxsale.com - OPENS 5/14/2010

Hillsborough County -

http://www.hillsboroughtaxsale.com - OPENS 5/10/2010

Indian River County -

http://www.indianrivertaxsale.com - OPENS 5/4/2010

Lee County -

http://www.leetaxsale.com - OPENS 5/3/2010

Levy County -

http://www.levytaxsale.com - OPENS 5/13/2010

Nassau County -

http://www.nassautaxsale.com - OPENS 5/5/2010

Orange County -

http://www.orangetaxsale.com - OPENS 5/17/2010

Palm Beach County -

http://www.palmbeachtaxsale.com - OPENS 5/6/2010

Polk County -

http://www.polktaxsale.com - OPENS 5/7/2010

Putnam County -

http://www.putnamtaxsale.com - OPENS 5/1/2010

Santa Rosa County -

http://www.santarosataxsale.com - OPENS 5/10/2010

Sarasota County -

http://www.sarasotacountytaxsale.com - OPENS 5/7/2010

Seminole County -

http://www.seminoletaxsale.com - OPENS 5/2/2010

Sumter County -

http://www.sumtertaxsale.com - OPENS 5/7/2010

Suwannee County -

http://www.suwanneetaxsale.com - OPENS 5/11/2010

Taylor County -

http://www.taylortaxsale.com - OPENS 5/7/2010

Walton County -

http://www.waltontaxsale.com - OPENS 5/14/2010

Step 2: Select a County and Sign Up

Lee

County, Florida is the home to Ft. Myers - a retirement destination known

for its warm gulf breezes, manatee habitat, and winter home to

famous personalities such as Thomas Edison and Firestone. I have been

traveling to Ft. Myers for nearly 20 years. In the last two years, it

has temporarily worn the number two dubious honor of foreclosure

capital of the U.S., losing only to Las Vegas.

http://www.LeeTaxSale.com

To start, click on the "Start Here" link and read through the rules.

To sign up, go to the "Register"

link on the right and click. You will be asked to sign up for an

account either using your name and social security number or company

name and Employer Identification Number (EIN). Note, you will have to

sign up for each sale separately. In February, Real Auction hosted the

Yavapai County, Arizona sale and later I tried to sign up for the Coconino

County, Arizona sale

with the same username and password. Real Auction instructed me to

create another username and password.

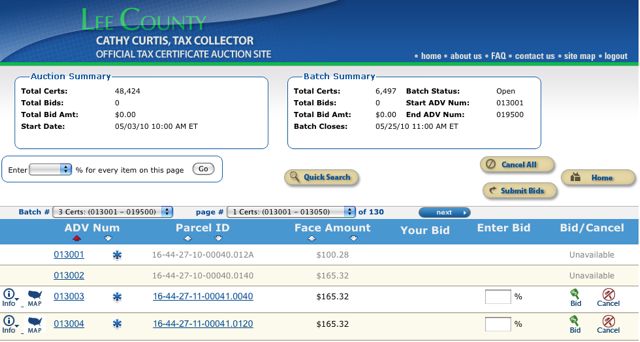

Real Auction provides an excellent summary for training purposes called "Site Guided Tour." On the left-hand side under training, click on the link.

https://www.leetaxsale.com/displayDocument.cfm?document_title=Guided%20Tour

If

your wish to look at the liens for sale, you can preview the liens by

clicking on the link on the right hand side. However, you cannot

purchase a tax lien until you have registered.

Step 3: Rules of the Sale

Please

review the rules of the sale, such as payment terms. The

rules of the sale are presented on the auction website. You are

required to make a 10% deposit. For example, if you anticipate spending

$10,000, then you will need to deposit $1,000 through automated

debiting or the ACH system.

Please

note that if you exceed the amount you've been approved for, your

remaining bids will not be accepted. Also, if you fail to pay for your

liens, your 10% bid will be forfeited.

Screening concepts to remember:

- Type of property - residential, commercial, land, agriculture

- Location

- Price or minimum bid

- Name of lien holder

- Improvements vs. land only

- Number of years of taxes due

- Other issues flagged, such as environmental concerns.

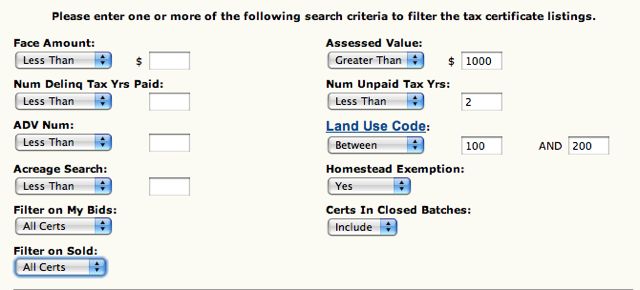

To screen using the Real Auction system, click on the "Quick Search" button and use the search criteria, such as land use codes, greater than or less than an assessed value, etc.

Land Use Codes

CODE LAND USE

0 VACANT

100 SINGLE FAMILY

200 MOBILE HOME

300 MULTI-FAMILY 10+ UNITS

400 CONDOMINIUM

500 COOPERATIVES

600 RETIREMENT HOMES

700 MISCELLANEOUS

800 MULTI-FAMILY <10 UNITS

900 TIME SHARE

1000 VACANT COMMERCIAL

1100 STORES, 1 STORY

1200 MIXED USE

1300 DEPARTMENT STORES

1400 SUPERMARKET

1500 REG SHOPPING CENTERS

1600 COMMUNITY SHOPPING

1700 OFFICE BUILDING 1 STORY

1800 OFFICE BUILDING MULTI-STORY

1900 PROFESSIONAL BLDG

2000 AIRPORT/BUS TERMS

2100 RESTAURANTS/CAFE

2200 DRIVE-IN REST

2300 FINANCIAL INST

2400 INSURANCE COMPANY OFFICE

2500 REPAIR SERVICE NON AUTO

2600 SERVICE STATIONS

2700 VEHICLE SL/SERV/RENT

2800 PARK LOTS, M/H PARKS

2900 WHOLESALE OUTLET PROD

3000 FLORIST/GREENHOUSE

3100 DRIVE-IN THEATER/OPEN STADIUM

3200 ENCLOSED THEATER/AUDITORIUM

3300 NIGHTCLUBS/BARS

3400 BOWLING ALLEY/SKATING RINK/PL

3500 TOUR ATTRACT-PERMANENT

3600 CAMPS

3700 RACE TRACKS

3800 GOLF COURSES

3900 HOTELS AND MOTELS

4000 VACANT INDUSTRIAL

4100 LIGHT MANUFACTURE

4200 HEAVY MANUFACTURE

4300 LUMBER YARDS

4400 PACKING PLANTS

4500 CANNERIES/BOTTLERS

4600 OTHER FOOD PROC

4700 MINERAL PROCESSING

4800 WAREHOUSE STOR/DIST

4900 OPEN STORAGE

5000 PASTURE + HIGHWAY

5100 PASTURE + MUCK/TILL

5200 PASTURE + WATERFRONT

5300 MUCK/TILLABLE

5400 TIMBERLAND

5500 PASTUER + TIMBER

5600 MUCK + WATERFRONT

5700 MUCK + HIWAY

5800 PASTURE + AC + PONDS

5900 BEES

6000 GRAZING LAND

6100 GROVE + MUCK

6200 GROVE + WATERFRONT

6300 PASTURE

6400 GROVE + HIGHWAY/WATER

6500 GROVE + PASTURE + ACERAGE

6600 GROVES

6700 GROVE-PAST + TILL

6800 DAIRIES/FEED LOTS

6900 ORNAMENTALS/MISC

7000 VACANT INSTITUTIONAL

7100 CHURCHES

7200 PRIVATE SCHOOLS

7300 PRIVATE HOSPITALS

7400 HOMES FOR THE AGED

7500 NON-PROFIT SERVICE

7600 MORTUARY/CEMETERY

7700 CLUBS/LODGES HALLS

7800 REST HOMES

7900 CULTURAL GROUPS

8000 NOT USED

8100 MILITARY

8200 FOREST, PARKS RECREATION

8300 PUBLIC SCHOOLS

8400 COLLEGES

8500 HOSPITALS

8600 COUNTY

8700 STATE

8800 FEDERAL

8900 MUNICIPAL

9000 LEASEHOLD INTEREST

9100 UTILITIES

9200 MINING

9300 SUB-SURFACE RIGHTS

9400 RIGHTS-OF-WAY

9500 RIVERS AND LAKES

9600 WASTELAND/DUMPS

9700 RECREATION AND PARK LAND

9800 CENTRALLY ASSESSED

9900 NON-AG ACREAGE

If

you would like to easily screen for the cheapest or most expensive

liens in a batch, use the Face Amount arrows and the list will be

resorted.

Example Sorts

1. All liens greater

than $1000 in value that are either houses or mobile

homes, homestead only and less than two years of unpaid taxes. The

purpose of this screen is to find liens that are likely to be redeemed

as these are properties where the homeowner lives. Again, please recall

that you can only have one homestead property in Florida.

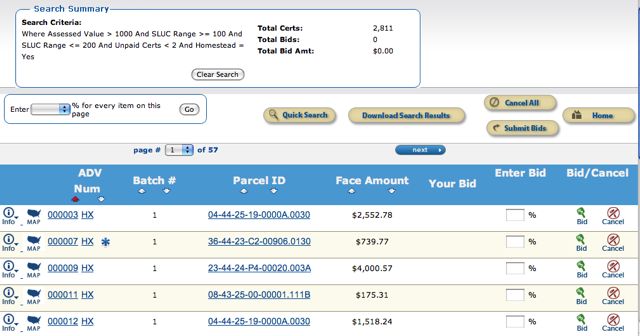

Partial results of first screen:

Here are some other screens to consider:

1. Commercial properties only with a value of more than $200,000.

2. Agriculture land with acreage of more than 5 acres.

3. Multifamily homes, condos or apartment buildings.

Important! Due diligence is done after you have screened your list down to a manageable level.

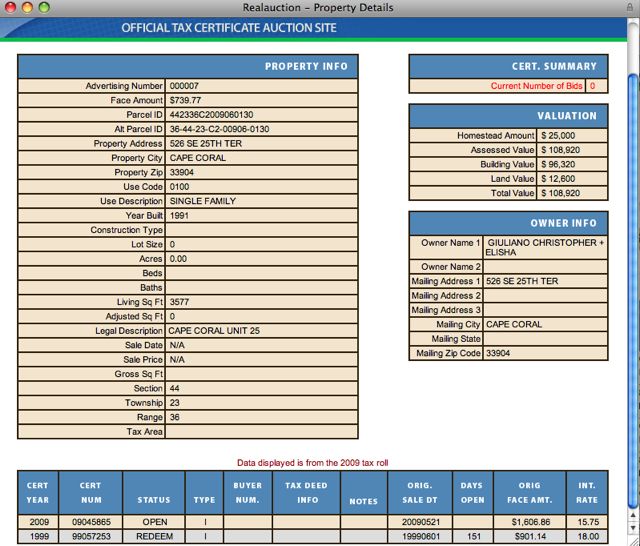

First,

let's look at the results of our list. One thing to note is the

asterisk on line two of the above image. If you click on this symbol you will see that an

existing tax lien is on the property.

HX - This means a homestead property or the property owner's primary residence.

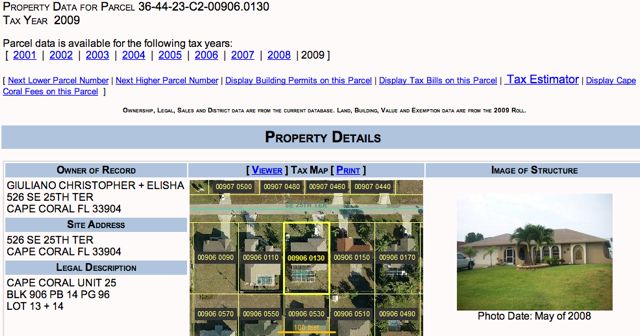

Property

ID - This will take you to the property appraiser information,

including pictures. This property is located in Cape Coral, which is a

nice location. The house looks well maintained.

ADV number -

This will show you the current number of bidders and more property information, as well as open taxes owed

(see below).

What about IRS liens or other problems?

Visit

the county recorder's office or clerk's office and look for recorded

documents. Mortgages, deeds, liens, etc. have to be recorded. To find

the recorded documents for Lee County, visit the link provided on the main LeeTaxSale.com website.

This

type of search is done through what is called the "Grantor/Grantee"

index. When you search this index, you need to search by property owner

name and if more than one owner is listed, search all owners'

names.

What about environmental problems?

A great resource for searching for major environmental concerns

(e.g., hazardous waste sites), is located at http://www.epa.gov/enviro.

This site allows you to search for Superfund sites, hazardous waste

sites, petroleum or gas stations, toxic or hazardous handlers, etc. Florida's State environmental agency is known as

the Florida Department of Environmental Protection. Its website is

at http://www.dep.state.fl.us. Some

important things to know about Florida. Much of the state is underlain

by a limestone aquifer, which has partially dissolved in places

resulting in caves, caverns, and solution or sink holes. Occasionally,

you will hear of a house or street that has been engulfed by a sink

hole. While traveling in Florida, I have even seen billboards for

attorneys representing sink hole victims. This same aquifer is

extremely shallow and has been contaminated in a number of places. A

common problem is overuse of pesticides and herbicides. Florida has a number of sensitive or protected species, such as mangroves and manatees. What about flooding?

One

of the amazing things about Florida is that a great deal of the State

is a flood zone. It is literally only a few feet above sea level, so

storm surges and intense rainfall can cause flooding. On the other

hand, the soil is very permeable and rainwater quickly dissipates. Again, visit your favorite search engine, type in "FEMA Map Store" and go to

www.FEMA.gov. For Lee County flood zones, visit this link: http://www3.leegov.com/dcd/pdfs/HowToUseLeeSpInS.pdfWhat about bankruptcy? Bankruptcies

are often recorded with the county government; however, bankruptcy is a

federal process so it is best to check with the federal district court. There

are three U.S. bankruptcy courts in Florida:

Florida Middle District Court:

http://www.flmb.uscourts.gov

Court Locations: Fort Meyers, Orlando, Jacksonville, Tampa

Counties of Jurisdiction: Baker, Bradford, Brevard,

Charlotte, Citrus, Clay, Collier, Columbia, De Soto, Duval, Flagler,

Glades, Hamilton, Hardee, Hendry, Hernando, Hillsborough, Lake, Lee,

Manatee, Marion, Nassau, Osceola, Orange, Pasco, Pinellas, Polk,

Putnam, Sarasota, Seminole, St. John’s, Sumter, Suwannee, Union,

Volusia

Florida Northern District Court::

http://www.flnb.uscourts.gov

Court Locations: Gainesville, Panama City, Pensacola,

Tallahassee

Counties of Jurisdiction: Alachua, Bay, Calhoun, Dixie,

Escambia, Franklin, Gadsden, Gilchrist, Gulf, Holmes, Jackson,

Jefferson, Lafayette, Leon, Levy, Liberty, Madison, Okaloosa, Santa

Rosa, Taylor, Wakulla, Walton, Washington

Florida Southern District Court:

http://www.flsb.uscourts.gov

Court Locations: Ft. Lauderdale, Miami, West Palm Beach

Counties of Jurisdiction: Broward, Dade, Highlands, Indian

River, Martin, Monroe, Okeechobee, Palm Beach County, St. LuciePalm

Beach County, St. Lucie Step 7: Purchase

When you are ready to place a bid, you will first have to have money in your account. Place

your bids realizing that the system uses proxy bidding. This means

you can decide how low you are willing to go in terms of interest and

the system will bid on your behalf to the highest winning bid amount in

1/4% increments. For example, if you bid 1/4% and the next lowest bid

is 14%, you would win the bid at 13 3/4% interest. If you tie, the

system will randomly select a winner.

Step 8: Manage Your Liens or Deeds

You

will be notified by email of your winning bids and any amount you

should be refunded or the amount due. Remember that you have two years.

After year one, you have the option to pay for subsequent taxes and

receive the same interest. If, after two years, your lien has not been

redeemed, you will apply to the county to take the lien to the tax deed

sale. Florida is unlike any other state because the tax lien investor

does not have the first right to foreclose. At the tax deed sale, if no

one bids on the lien, then the tax lien investor can foreclose and take

ownership; otherwise, another investor may outbid the tax lien investor

and he/she will have to pay the amount of the lien plus fees that the

tax lien investor incurred to take it to the sale.

Tax deed sales are held based upon the number of applications in a particular county.

Once

again, it pays to be organized both electronically and with your

paperwork. I use Excel and a folder system my accountant developed

called the Tax Box.

All the best,

Michael

|