Hello

Premium Members,

California has been taking advantage of online bidding for several

years now. One of the first prominent companies responsible for

Internet auctions of county-foreclosed properties is Bid4Assets.

Whenever

I am looking for the latest online sales, I always check and see what

is listed on their site. To make things even easier, I am on an email

list so I usually when sales are coming up.

Bid4Assets

offers a few different services. In addition to helping counties sell

foreclosed properties, they also will list your properties for sale

with a fee of course, much like Ebay.

Here is the link to Bid4Assets: http://www.bid4assets.com.

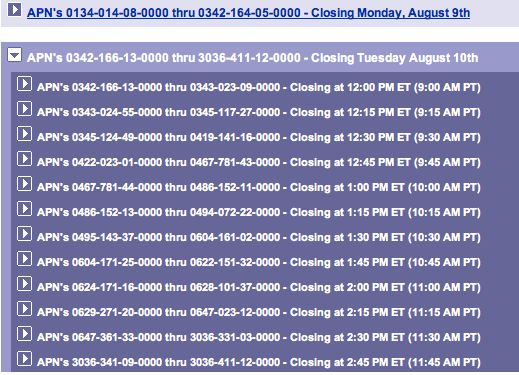

As you can see from the website, tax sales are in full bloom in California. The following sales are coming up:

- San Bernardino: August 7 - 9, 2010. You must register by August 3, 2010 at 4:00 PM Eastern Time

- Inyo: August 14 - 16, 2010. You must register by August 14 - 16, 2010 at 4:00 PM ET

- Ada: August 21 - 24, 2010. You must register by August 17, 2010 at 4:00 PM ET

- Sonoma: August 21 - 24, 2010. You must register by August 17, 2010 at 4:00 PM ET

Start by setting up an account and registering with Bid4Assets

http://www.bid4assets.com/help/index.cfm?fuseAction=howToParticipate

The following are necessary steps to participate in the Tax Deed Sale:

1. Registration - usually 7 days in advance.

2. Property Research - done online or at the County.

3. Place BidDeposit - For San Bernardino, a $1000 Deposit is required.

4. Bidding - online

5. Auction Ends - as shown.

This is all explained very well on the Bid4Asset's website.

http://www.bid4assets.com/help/index.cfm?fuseAction=howToParticipate

California and San Bernardino

First, let's look at San Bernardino, but remember you must sign up by

tomorrow (August 3rd) if you want to participate. The Sonoma sale is

also coming up and you have until August 17th to register.

San

Bernardino is the largest county in the United States. In fact, in area

(about 20,000 square miles) it is larger than nine U.S. states. There

are about 2 million people that live within the county limits as well.

The point here is that San Bernardino County is like investing in an

entire State and they typically have at least two sales per year.

Tip:

At past sales in San Bernardino, the best deals seemed to be on the

outskirts of the cities, in rural areas. This makes sense because

bidders have a harder time doing research on these properties.

What you need to know about California Tax Deed Sales

California

is authorized to sell tax lien certificates (18%), but no sales have

been conducted. At least one county has considered having a tax lien

sale. Instead, California uses the tax deed process. State law refers to their process as Tax-Defaulted Land Sales.

After

five years of tax-defaulted status, defaulted properties become subject

to the "Power to Sell." These properties may be sold at future

auctions, unless redeemed for the full taxes, penalties, and other

associated costs.

Unfortunately, state law does not allow for

an over-the-counter process so you cannot buy tax-defaulted properties

through the mail. California has been on the leading edge of Internet

auctions and Bid4Assets seems to be the vendor of choice for many

counties.

In California, the deed is not clear for at least

one year due to California’s one-year legal challenge period. The legal

challenge period is a safeguard for homeowners in case the sale was not

conducted properly or all owners were not notified. Of course, this is

not an easy process for someone who wishes to challenge a sale; in

face, it must be done through the courts. In the event of a successful

legal challenge, the investor has to be compensated for what she paid,

but improvements may not be reimbursed.

During this one-year

challenge period you are still the owner and you have rights of

occupancy, rental, even sales through a contract for deed. However, you

will not be able to get a free and clear title until this period is

over and you quiet the title. Most title insurance companies will not

issue a title policy until after the one-year challenge period has

ended.

By the way, quieting a title is a legal process that

involves title research and generally using the court to issue notice

to any potential lien holder, person or entity that may have a right to

the property. Typically, the court issues public notice and if no one

responds, then they loose their rights to the property. After the

process is finished, the deed has more warranties or guarantees for its

owner.

The legal challenge period is not a

right-of-redemption period, so please don’t confuse that with the

right-of-redemption process that occurs in some other tax deed states

like Texas and Georgia.

Tax-defaulted sales occur year round

and according to state law each county must conduct a sale at least

once every four years. State law dictates that the minimum bid for

property offered at a public auction tax sale be an amount not less

than the total amount necessary to redeem the tax default, plus cost.

An exception is when property interests have been offered at a previous

sale and no acceptable bids were received. Pursuant to Section

3698.5(c) of the California Revenue and Taxation Code, the Tax

Collector may offer that property or property interest at a minimum bid

that is less than the amount of the tax default, plus cost.

California

conducts a great number of tax deed sales, with more than 10,000

individual parcels sold every year. California is an above average tax

deed state. In most cases you will need substantial capital to bid on

properties since property values are so high. Be careful not to overbid

on properties at highly competitive auctions. Do your research, stick

to a number that provides safety and don’t budge.

I am not

comfortable paying more than 75% of the true market value and my goal

is 50%. That provides me with a nice safety factor and a good deal.

During the early to mid 2000s, especially 2005 through 2007, real

estate values skyrocketed in many locations in California.

Consequently, bidding at tax deed sales would sometimes exceed market

value (i.e., over 100% of value). In the last two years, reason has

prevailed, but I cannot guarantee sale because of the sheer number of

people living in and wanting to live in California.

What else should you know about Investing in California?

Mello Roos

Community

Facilities District Act (more commonly known as Mello-Roos) was a law

enacted by the California State Legislature in 1982.[1]. A Mello-Roos

District is an area where a special property tax on real estate, in

addition to the normal property tax, is imposed on those real property

owners within a Community Facilities District. These districts seek

public financing through the sale of bonds for the purpose of financing

public improvements and services.[2] These services may include

streets, water, sewage and drainage, electricity, infrastructure,

schools, parks and police protection to newly developing areas. The tax

paid is used to make the payments of principal and interest on the

bonds (http://en.wikipedia.org/wiki/Mello-Roos).

I mention this because it is a public tax and may not be extinguished through the tax sale process.

Proposition 13

Proposition 13 (officially titled the People's Initiative to Limit

Property Taxation) was an amendment of the Constitution of California

enacted in 1978, by means of the initiative process. The proposition

lowered property taxes by rolling back property values to their 1975

value and restricted annual increases in assessed value of real

property to an inflation factor, not to exceed 2% per year. It also

prohibited reassessment of a new base year value except upon (a) change

in ownership or (b) completion of new construction

(http://en.wikipedia.org/wiki/California_Proposition_13_(1978)).

This

is important to know because when you are checking property values, the

value may be artificially low; however, when you takeover as a new

owner the tax can be reassesed and you end up at a higher tax rate than

you thought.

1915 Improvement Bond

This

is a special assessment for improvement of streets, curbs, gutters,

sewers and basic infrastructure. It is a goverment lien and holds

priority over mortgages or other private liens. When doing your

research, please check for any bonds. Like Mello Roos, a special

assessment may not be extinquished.

Dissenting Tax Jurisdiction

Any city or taxing jurisdiction may dissent to a sale and therefore their taxes may not be extinquished.

Federal IRS Liens

This

is always a subject that engenders a lot of interest. Internal Revenue

Service (IRS) liens are not necessarily extinguished through the tax

foreclosure process. However, what you should know is this:

- The county should have performed a title search and notified all lien holders before the sale.

- The IRS may decide the equity is not worth going after.

- The IRS has 120 days to decide from the point of notification.

- If

you find out a your newly acquired property has a federal tax lien, it

may best to wait 120 days before notifying the IRS to obtain a release.

- This is complicated and the best option is to do your research and if a federal tax lien shows up, move on to the next property.

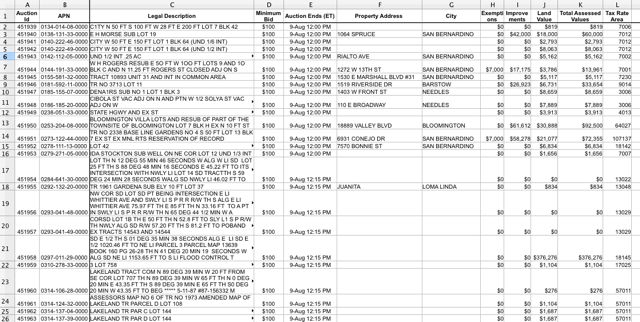

How to screen and sort using a spreadsheet list

Visit this link and download the Excel spreadsheet:

http://www.bid4assets.com/storefront/?sfid=536

Load the spreadsheet in Excel, Open Office or another spreadsheet program.

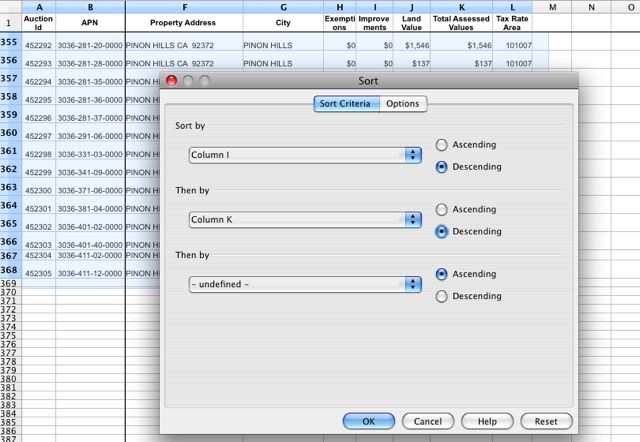

Select

the range of data, which run from rows 1 through 368 and perform a

series of sorts. I like to sort in desending order based upon total

value and also improvements.

Try this and see what you come up with.

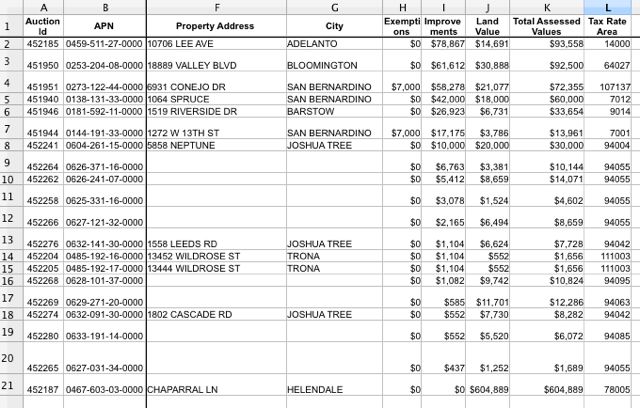

After selecting the range and sorting, this is what you should come up with.

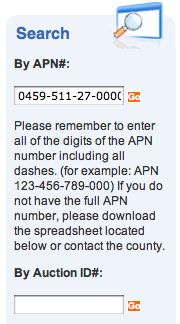

Now use the Bid4Assets search feature and enter the APN number and start doing your research.

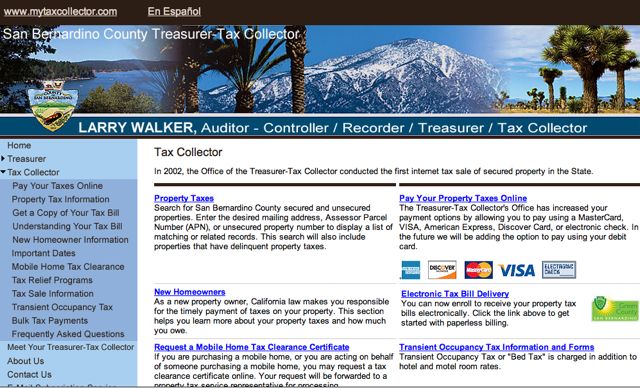

You can also use the APN number directly on the County website.

The San Bernardino site is located at MyTaxCollector.com.

Be sure to check for redemptions and delete those from your

spreadsheet. The redemptions are listed on the Bid4Asset's website.

This is very important because you don't want to do research on a

property that has redeemed.

Knowing

how to sort data is crucial. This one concept can save you a lot of

time and frustration. I know it is a little computer "geeky," but so

what...it really helps. If you encounter that has thousands of liens,

like I have seen in Arizona or Florida, you will really want to take

advantage of anything that speeds up the process of screening.

Once

you have the list paired down to a manageable level, then you can take

the APN numbers and look up additional information as shown above. In

other cases, you will want to take your screened list, say the top 10,

and run the property numbers through the three most important websites:

1. The Tax Collector

2. The Appraiser

3. The Clerk/Recorder

Questions:

In

researching APN 0626-241-07-0000, the ownership showed two people and a

business. How is that possible? What does Tenancy in Common mean?

Research

APN 0253-204-08-0000 and determine if it is vacant land or has a

house/building. Did you find the Google Street View link?

Find

the Recorder's office and do a grantor/grantee search on the property

owners of APN 0273-122-44-0000. Could you find the notice given by the

County for tax delinquency and notice to sell? Hint...use this link

http://www.sbcounty.gov/acr/RecSearch.htm and click on the

Grantor/Grantee index. You will use the property owner's name. If there

are two owners, search both names.

Very best,

Michael