Dear Premium members:

We are profiling the Jefferson County Colorado

online sale:

In Colorado you will find tax sale information at the Treasurer's office.

http://www.co.jefferson.co.us/treasurer/treasurer_T68_R9.htm

Don't forget the Assesor's office: http://www.co.jefferson.co.us/ats/splash.do

and the Clerk's office: http://www.jeffco.us/cr/index.htm

Step 1

Get

on the Jefferson County Treasurer's website and register for the sale.

You will also need you to fill out a W9 form, sign it and send it in

to the county along with a voided check. This needs to be done this

week. You will send it to:

Jefferson County Treasurer

100 Jefferson County Parkway, Suite 2520

Golden, Colorado 80419

or

Fax: 303-271-8359

Step 2

Register with SRI

http://www.sri-auctionsonline.com/

Step 3

Go through the County's Power Point presentation.

Download it from this page:

http://www.co.jefferson.co.us/treasurer/treasurer_T68_R10.htm

For your convenience, I converted it to PDF format

so you can view the same presentation at:

http://www.rogueinvestor.com/training/2010_Jefferson_Co.pdf

Step 4

Download the list in Excel format if you can:

http://www.co.jefferson.co.us/treasurer/treasurer_T68_R15.htm

**Please note that you can get a free version of

Open Office that will allow you to use Word, Excel or Powerpoint

documents (www.openoffice.org).

My first screen is always for redemptions. I am sorry to

say that Jefferson County only updates a separate file with the

redemptions. So, although they are way ahead of the game on training,

updating the redemptions in this manner is sorely lacking.

Nevertheless,

here is a download link of the Excel file with redemptions highlighted

in red and partial payments highlighted in blue.

http://www.rogueinvestor.com/training/Jeff_screen01.xls

Take this file and remove all of the rows listed in red. These have been redeemed.

As

of Monday, the county listed a new update of redemptions and I have

included those as a darker shade of red. You can find this list posted

at:

http://www.rogueinvestor.com/training/Jeff_screen02.xls

Again, this is a frustrating way to present redemptions, but I have seen it done this way before.

This

brings up a point that is extremely important. In this game, it doesn't

pay to prepare well ahead because last-minute redemptions are common.

Even comparing the list from screen one to screen two, you can see

several redemptions.

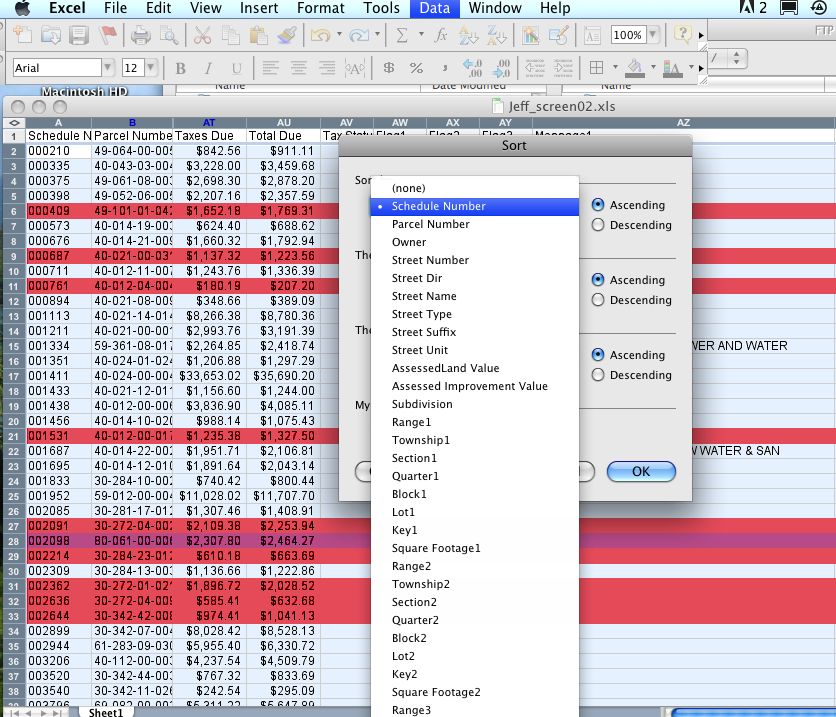

Sorting using a Spreadsheet

To sort

using a spreadsheet, such as Excel or Open Office, first highlight the

entire area usually starting from just below the column headers all the

way to the bottom. You can typically do this by clicking on the A2 cell

and holding the shift button while scrolling to the end of the data.

This is important, so please ask a friend if you don't know how to

highlight.

Next, go to Data, Sort and you will see the column

names if they are labeled, otherwise they will be column A, B, C, etc.

Now, you can sort in ascending or decending order.

Here is

what it should look like. Note, I did not use the Schedule Number as a

sort, it is only shown as the first column listed.

Please

remember that the liens in red or purplish red have been redeemed. I

could have just as easily deleted these rows. In fact, I will soon. To

delete a row, simply click on the row number at the far left so that it

highlights the entire row, then you can right click and delete or edit

and delete.

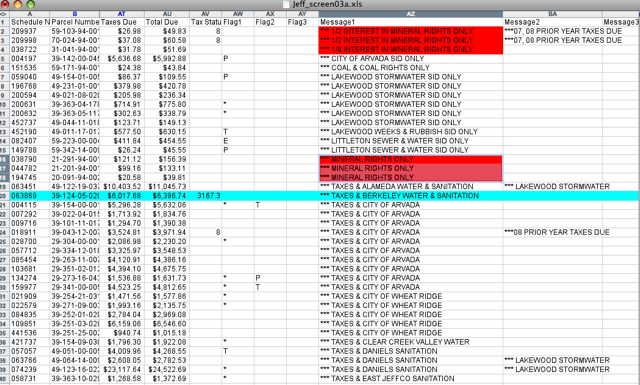

Here is the file with red highlights deleted:

http://www.rogueinvestor.com/training/Jeff_screen03.xls

Common Screens

Some

things are just not worth your time and should be removed. Please look

through the list and note items of concern, such as "1/2 Mineral

Interest" and "Unbuildable" and remove these items.

Here is the updated list with these items removed. You will find these listed on the column entitled Message1.

http://www.rogueinvestor.com/training/Jeff_screen03a.xls

Tax Status

7 = State liens. This

is probably not worth your time researching. State liens are not

removed through the tax lien process so, consider screening these out

like I have.

Liens (Interest only)

If you would like to continue on, please consider these screens:

Partial Payments

One

of the first things to note is the partial payments shown in blue. This

tells me that these individuals and companies are motivated to pay

their taxes so the probability of redemption is high. In other words,

they will most likely pay and you will earn your interest, but your

chance of foreclosure is limited.

The partial payments are listed shown with the balance remaining on the column to the right of the original balance due.

Improvements vs. LandImproved

property always has a higher liklihood of being redeemed. However, you

can check the property address versus the owner's address and learn if

the property is owner-occupied or a rental or vacation property.

Rentals and vacation properties have a lower chance of redemption.

Consequently, if you are looking to turn a lien into a deed, you will

want to focus your energy on non-owner occupied properties.

Land

usually always has a lower probability of redemption. In other words,

most people are willing to give up lots, land and rental properties,

but their owner-occupied homes are the last to go.

Finally - Don't Pay Too Much

Among

other screens, I have added a column that includes my maximum bid so I

know where to stop. Based upon the previous two years, a reasonable

maximum overbid is about 2.5%. Please know that your maximimum overbid may

be zero or 5%. That depends upon your level of risk.

Let

me explain. You will actually bid the amount. So, if the lien amount is

$1354.23, that will be your initial bid. You then have the option to

bid a higher amount say $1355.23 or $1356.23. However, remember that

you do not receive interest or get any of the overbid back. I you are

the winning bidder at $1356.23 and the original lien amount is $1354.23

you have bid $2 over the original amount. In percentage terms, your

overbid is only 0.15%. To stay below a maximum cutoff of 2.5% over, you

should not exceed about $33 over or a total bid of $1387.23.

You will receive 10% interest on $1354.23 only.

If you plan

on bidding on residential houses or what I call high quality liens, you

will probably have to include an overbid. If you are bidding on land,

lots or commercial properties, your competition may be limited so your

overbid will not have to be as high.

http://www.rogueinvestor.com/training/Jeff_screen03b.xls

Wishing you the best,

Michael

P.S., Remember the sale is Today...Thursday, October 21.

Login to SRI and find the Colorado link under auctions.

http://www.sri-auctionsonline.com/

Here is what the sale will look like:

Note

that you can place your bid to the right. Also, you can sort the list

by ending time, title or price. Please take your spreadsheet list and

compare it to the schedule number for any liens you are interested in

buying. The sale ending time is shown below each lien.