February 1, 2013

Arizona

Tax Lien Sales Part 2: Coconino Online Auction

Dear Premium Members,

Welcome to part two of the 2013 Arizona

Tax Sales.

Tax

lien sales are in full swing in Arizona. By law, all sales occur in

February of each year; however, tax sale lists are typically released

in a local newspaper of each county about two to three weeks in

advance. Consequently, many tax lien lists are now available.

With online auctions, a strange thing has happened. Counties are able

to show the lists on an auction site. You can even sign up and place

bids. That’s the case in Coconino County, which is where Flagstaff

resides. The catch is your bids are just held in a queue until the

actual auction date. In the case of Coconino, the auction is February

12, 2013.

I have never done much research in Coconino, but I’ve always wanted to.

Having traveled throughout the county, I know it is beautiful. My

problem was I could never get passed my love affair with Yavapai County

(home to Sedona and Prescott). Anyway, I am excited to look into this

sale and see what it yields.

Before we go any further, take a look at our calendar and do some

planning and perhaps you can attend more than one online auction or if

you are really courageous, try a live auction.

Arizona Counties with Online Auctions

• Coconino County – https://www.coconinotaxsale.com

• Pinal County – https://www.pinaltaxsale.com

• Yavapai County – https://www.yavapaitaxsale.com

• Mohave County - https://www.bidmohave.com/

• Maricopa – http://www.bidmaricopa.com

Deposit

To be eligible to win certificates (not bid) you must meet the county’s

deposit requirements. Generally the county requires 10% of the

anticipated winnings be held on deposit before a bid is considered,

although such rules may be defined by the county in advance and may

differ.

For example, if you place a deposit of $500, you cannot win more than

$5,000 in certificates. You will usually be required to use the

Automated Clearing House (ACH) system to deposit money from your

checking or savings account. If you need to send a cashier’s check,

consult directly with the county. I missed out on a sale once because I

was trying to use self-directed IRA funds, which cannot be deposited

using the ACH system, unless you have a business structure tied to your

IRA. This is another lesson, though. Some counties will let you

send cash, make wire transfers or pay using a cashier’s check.

Batches

As the site makes clear, certificates are combined in groups called

batches. The county decides the size of the batches; however,

generally they are blocks of 500 or 1000 certificates each.

Auction Day

Each County chooses the day when the auction officially ends. At

a specific time on that day the first batch officially closes and

winners are determined.

Results are posted within 5 minutes of a batch closing.

Additional deposits can also be made at anytime during the sale. Be

careful not to base your entire bidding strategy on the results of the

first batch closing. Like physical auctions, often times the early

money is the dumb money. What I mean is people often spend too much

early in an auction and then settle in to more reasonable bids.

I often train students to start from the end of a list and work towards

the beginning, and then if you run out of money, you have a better

chance of getting a good deal toward the end.

Having said that, online auctions like this one allow you to sort for

certain criteria, irrespective of the batch number. So, although I have

seen my “late bird gets the worm” strategy work many times, it is not

quite as robust with online auctions.

Pay for Certificates

After all batches have closed, the bidder can pay for his/her certificates through the ACH wizard on the site.

Important Things to Remember

* The asterisk on the Tax Sale List is used to indicate parcels that

have prior tax years due or an existing lien, but because of unpaid

subsequent taxes they are going back into sale this year. If you

purchase one of these parcels with a prior lien or prior year you are

required to buy out the prior lien as well as the current lien.

P - Possessory rights parcels are strictly the improvements on the

land. In the case of possessory rights and utility company parcels, we

ask for you to be very careful and have a complete understanding of

what you are bidding on before you bid.

Enough with the babble, let’s get started.

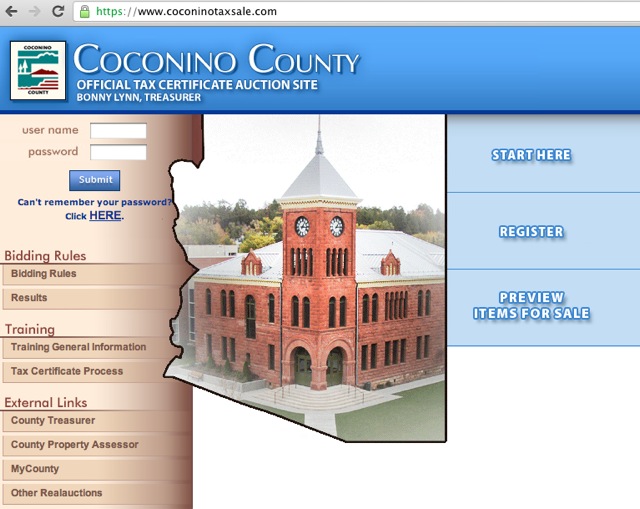

First, find CoconinoTaxSales.com website. This is the site that Real

Auction runs for the County’s benefit. If you want to visit the actual

County Treasurer’s website, there is a link on this site or you can

find it by using your favorite search engine or NACO.org.

Click on Start Here and read through the rules. Also revisit the

January 2013 Premium Report on Arizona Tax Lien Sales. Real Auction

also has a couple of webinars, which I have never taken advantage of,

but it might be a good idea.

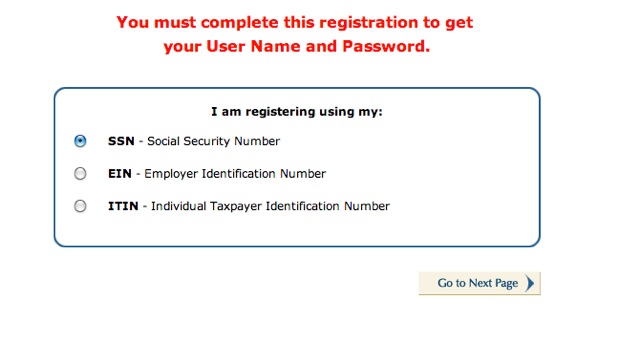

Next, visit the Register link.

Here you will signup using your social security number, employer

identification number (if you are using a business, such as an LLC), or

an individual taxpayer identification number if you applied to the IRS

for a number. Non-U.S. citizens often use ITINs. The purpose of this is

to keep track of your taxable earnings.

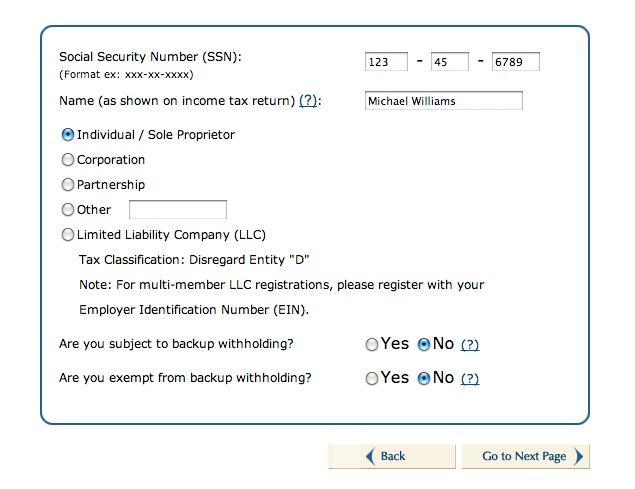

For this sale and for illustration purposes, I am registering as an

individual. As for backup withholdings, the default is no. Most

individuals will not be subject to backup withholdings.

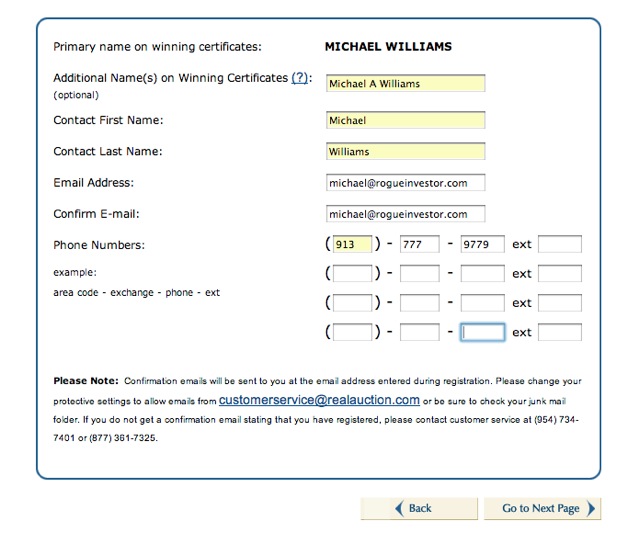

Insert your name and email address.

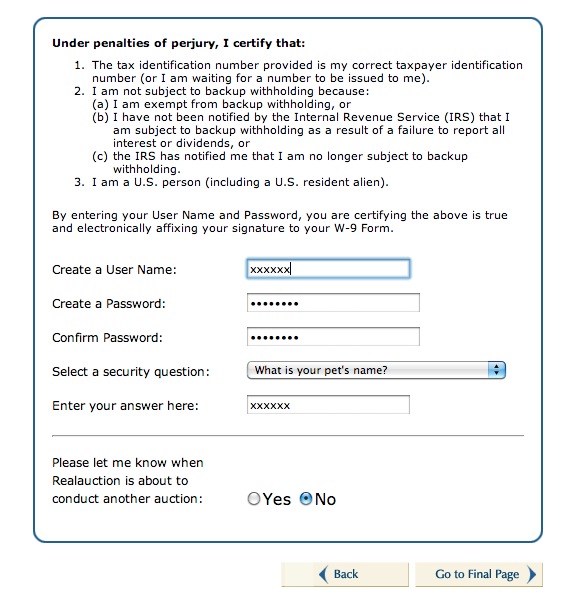

Next, setup a username and password.

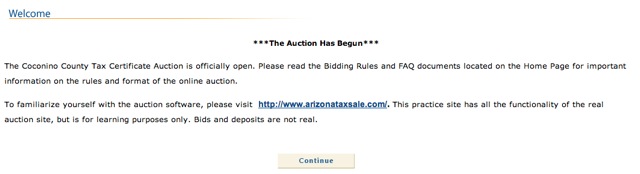

It looks like everything has gone through. The “Auction has begun.”

Well, sort of. Actually, it really hasn’t started in my mind, but we

can do our research and place our proxy bids. It’s just that the actual

live part of the auction hasn’t started.

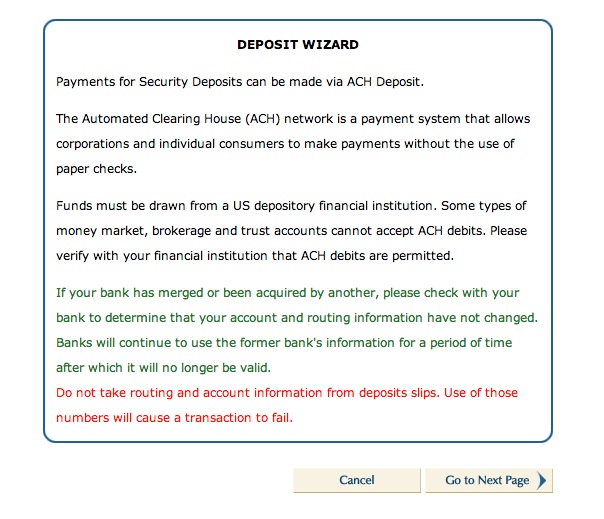

Placing Your Deposit

Return to the main CoconinoTaxSales.com page and find Make a Deposit.

Click on this link and you will be directed through making your deposit.

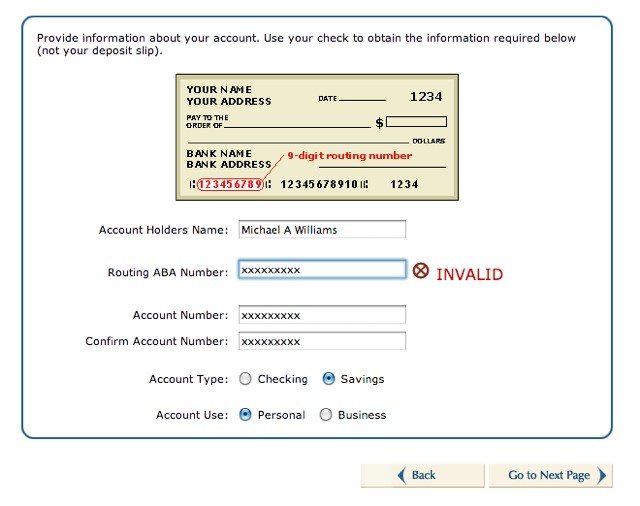

Notice the INVALID message. That’s because I entered a fake ABA number.

Once I entered my correct routing number, it was verified instantly.

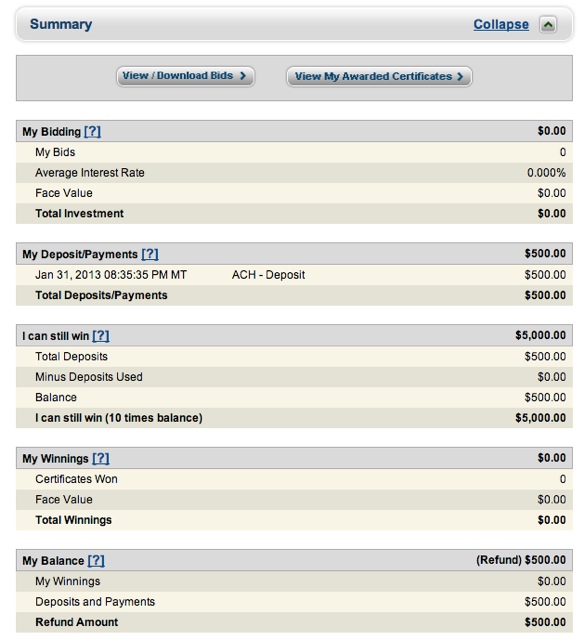

Okay, we are getting close now. I can feel it. I will start by placing

a deposit of $500, which allows me to bid on up to $5000 worth of

liens. Should I decide not to bid on anything, the County will refund

my money a couple weeks after the sale.

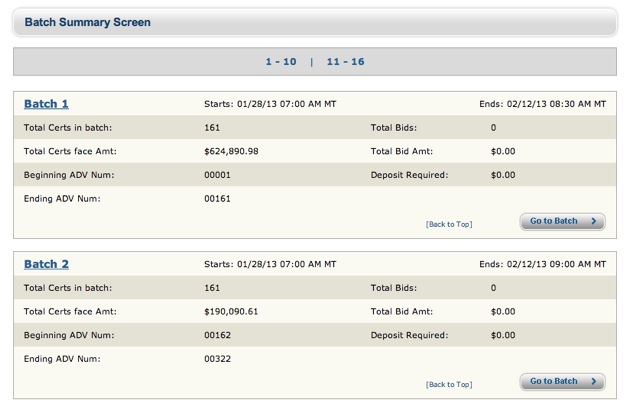

Click on Place Bids and you will see what the batches look like. In

fact, you can go through each batch and when you are ready to place a

bid, this is where it’s done.

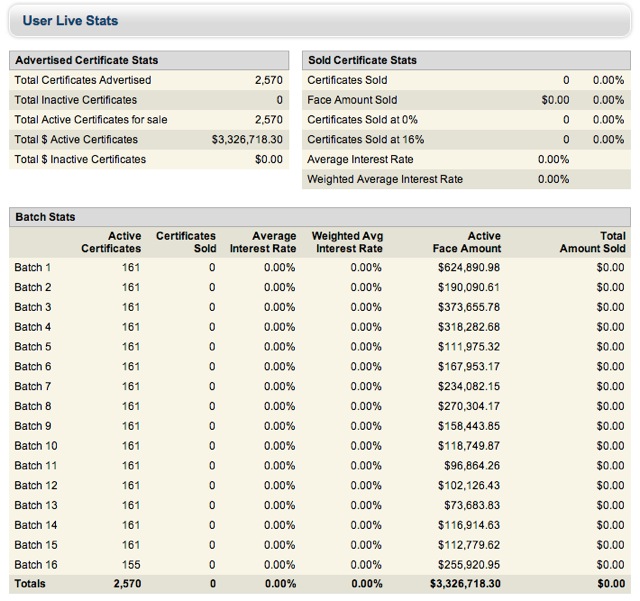

What I think is really interesting is the User Live Stats. As you can

see, there are 16 batches with 2570 liens representing 3.3 million

dollars.

Okay, enough already!

“Show me the beef.”

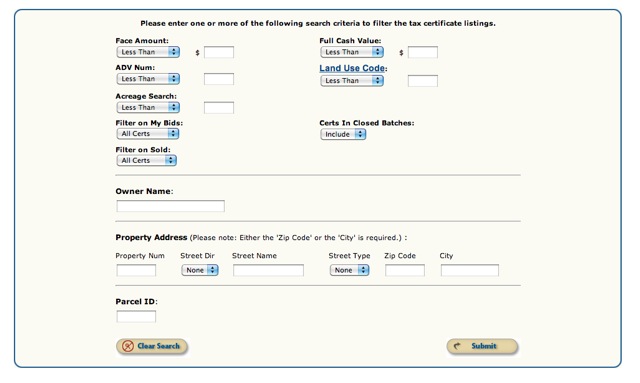

Go back to your home screen and find the link for the Quick Search.

This is where you can setup some screening criteria. Click on the link

to land use codes and you will find a huge list of property types. This

is an excellent screening device for anyone who is looking for liens on

certain property types.

Furthermore, you can screen on the value of properties or, one of my favorites, is acreage. I love land.

Before we go on, I want to talk about some strategy. As you might be

able to guess, the most popular property type is a residential house.

Why? Well, for obvious reasons, very few people will lose their own

house in tax foreclosure so the redemption rate is high. In other

words, you are likely to get your lien redeemed and earn interest. The

only problem is many other investors will be interested in these

properties as well. A bread and butter house in a nice neighborhood in

the city will oftentimes result in a low interest rate.

For the low risk, you are going to give up some of your return. Really

nice houses in Sedona are often bid to zero. Investors are just hoping

that an owner will maybe, just maybe not redeem. It’s silly because

they are just giving the homeowner an interest free loan.

So what do you do?

Well, if you are willing to venture out a little and consider land,

rentals, condos, apartments or commercial properties, the crowd starts

to thin out and the returns are typically higher.

Please understand that your risk tolerance will different than mine.

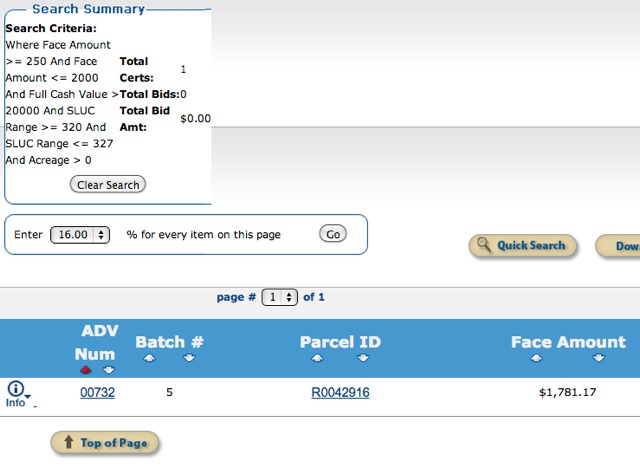

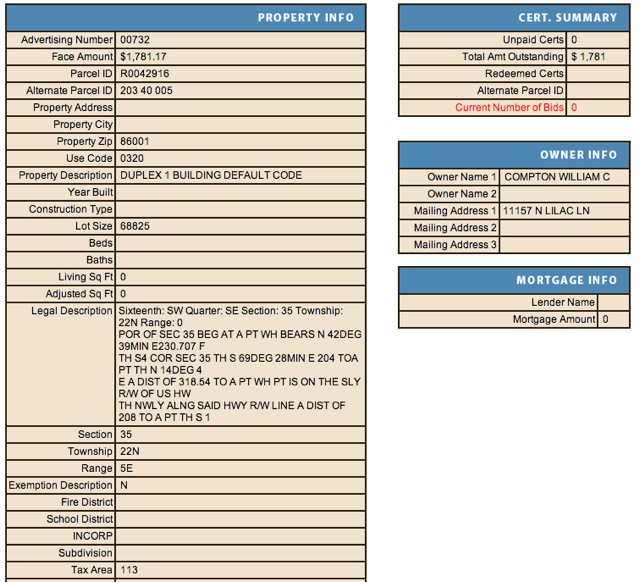

For example, I decided to look at duplexes, which include properties

with land use codes between 320 and 327. I also looked for liens with

values exceeding $250, but no more than $2000.

Using these really specific search criteria I am left with only one

potential certificate. Nevertheless, it is an interesting one – worthy

of further conversation.

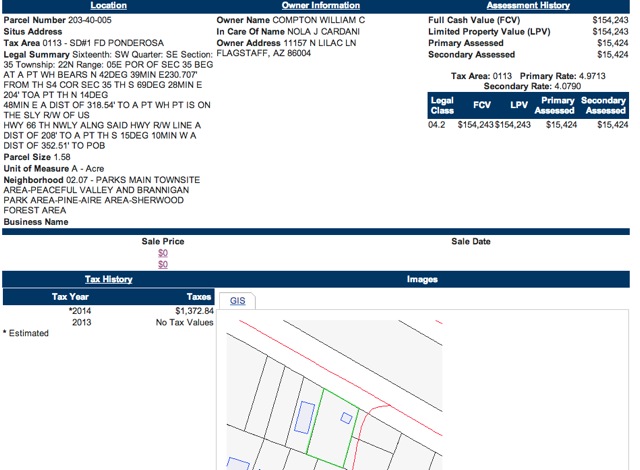

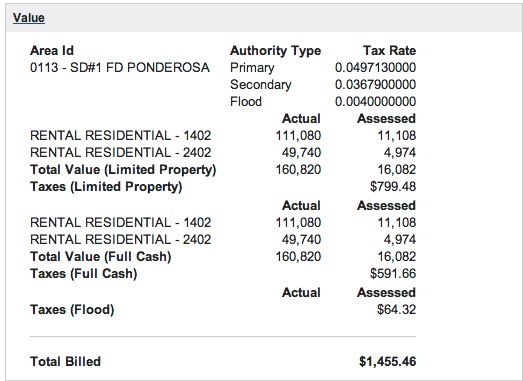

It is a duplex with a value exceeding approximately $150,000. It is

owned by a Mr. Compton, the property appears to have two units (i.e.,

duplex) and it is situated on 1.58 acres. So far, I like it.

One duplex unit must be worth much more than the other based upon the assessor data.

Finally, the face amount of the lien is $1,781.17. Right now there are

no competitors (as of February 1, 2013), which means a bid of 16% would

win this. Using proxy bidding, any bid from 1% to 16% would win. That’s

because with proxy bidding you set a minimum bid and the online

software adjusts upward in increments of 1%.

For example, if I were to place a bid of 14% on this lien, right now my

proxy bid would actually be 16% because there are no other bidders. If

another bidder shows up and sets a proxy bid of 7%, she would win the

bid beating my 14% bid with a bid of 13% (not 7%). Does that make sense?

It is really quite an ingenious system.

Okay, I have shown you only one possible screen for duplexes. Go crazy and try some other screens.

Let me know what you come up with. I am available for any questions. I

am going to do some more screens and I'll post some more results in

just a few days.

Happy Investing,

Michael Williams