|

Alabama Over-the-Counter (OTC) Tax Liens and Tax Deeds

December 3, 2012

Dear Premium Members,

As you know by now, tax lien sales are governed by state laws, some of which dictate one sale per year. In many cases, you literally have to wait until the next year to invest in that state. In other cases, state laws allow for tax lien certificates and tax deeds to be sold through another process.

This process is referred to as over-the-counter (OTC), by mail, sold to the state, county held, struck off or many other names. In general, it means you can buy directly through the county or state and oftentimes earn the maximum interest.

This month I am profiling Alabama. Alabama is one of my favorite states to purchase liens and deeds through the OTC process. In Alabama this process is referred to as "Sold-to-State." That's because the liens are literally struck off or sent to the State.

The entire list of Sold-to-State liens (less than 3 years old) and deeds (more than 3 years old) is available at this link:

http://www.revenue.alabama.gov/advalorem/transcript/transcript.htm

In short, what you need to know about Alabama is liens automatically become deeds in 3 years so if you are looking at the list and the lien is older than 3 years, you are buying a lien that has matured to a deed. The date starts from the date of the tax sale.

Alabama tax lien auctions occur in May of each year.

The interest rate is 12%.

The redemption period is 3 years.

"Sold to State" properties are parcels that were offered at a past annual tax sale, and were not purchased at that time. As provided by Code Sections 40-10-21 and 40-10-132, the State of Alabama RevenueDepartment offers for sale tax certificates and tax deeds, which are currently in the possession of the State.

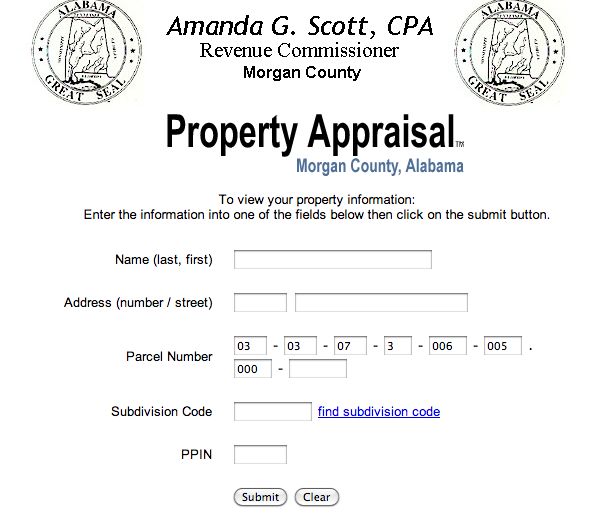

How do you purchase certificates from the State of Alabama? You must have the parcel number of the certificate you wish to purchase.

The completed form will be electronically sent to the State Department of Revenue. The State Revenue Department will respond to your application by mailing directly to you a price quote letter. You will have twenty days to respond to the price quote by sending in a cashier's check for the stated amount.

How do you know if you will get a certificate or tax deed? Tax deeds are issued on properties that have

been delinquent for more than three years.

When will you get a document from the State? Once the State receives your payment, they will begin

processing either a tax certificate or a tax deed, whichever is appropriate. Upon completion of that

document, they will mail it directly to you, in approximately 6 to 8 weeks.

What do you do with my certificate? Keep it in a safe place. If the property is redeemed, you will be

notified to return it to the County to get your money back plus interest. If the property is not redeemed prior to the three-year anniversary of the original sale, send the certificate to the County office and exchange it for a tax deed (a small fee will apply).

What do you do with tax deeds? Record them immediately in the Judge of Probate Office and consult your

legal sources regarding possession and use of the property.

Step 1: Visit the The Alabama Revenue Site

Step 3: Look over the list and screen it.

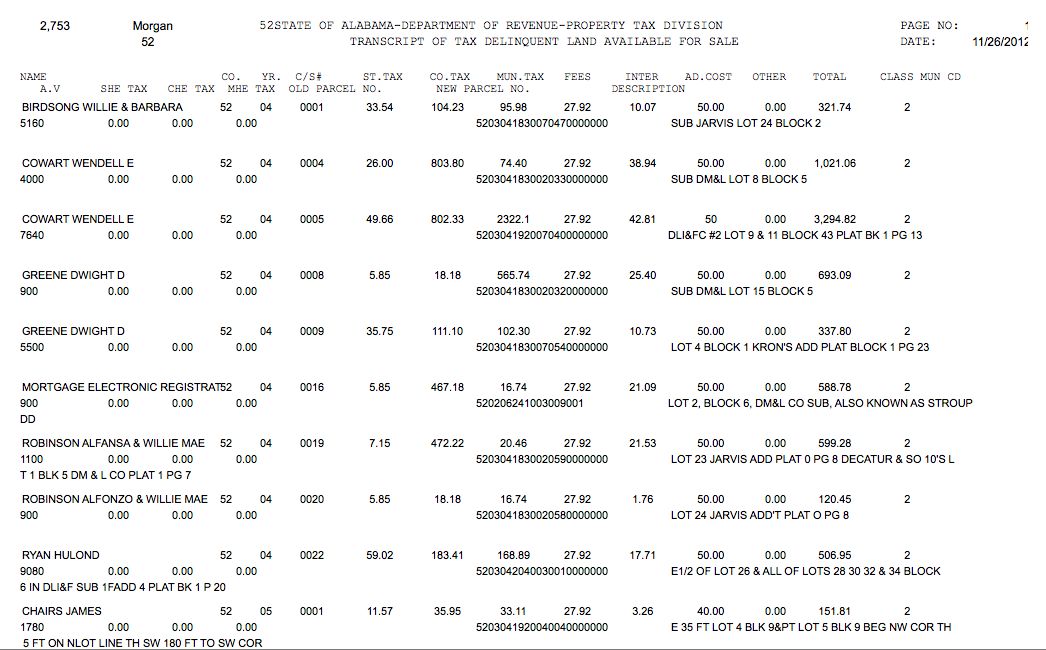

Here is the first page of the list. Unfortunately, it is presented in a PDF format so it cannot be screened as easily as a database or spreadsheet. Let's look at the list and see what is shows.

Name: The tax payer's name

Co.: County 52 is Morgan County.

Yr.: This is the year of the lien or deed. In this case, the year is "04" so these liens were offered in 2004.

C/S#: Certificate of Sale #, which is generally meaningless for us.

ST. Tax, Co. Tax, Mun. Tax, Fees, Inter, Ad cost, Other and Total: These are the taxes and fees owed by the property owner. The total amount is what you will have to pay. You will therefore earn 12% on the total amount shown if your bid is approved.

Parcel No.: Example, number 5203041830070470000000 is the parcel number of the first property and the Description is the Legal Description, shown a s Sub Jarvis Lot 24 Block 2. Notice that the address is not shown. Addresses do not have to be shown; by law, only the legal description has to be given.

How do you find the address so you can do a Google Maps fly by? Take the Parcel number and go to the Tax Assessor's website and look it up.

Okay, based upon this first page, I would screen out everything. Do you know why?

The answer is these liens are too old. On OTC lists old liens/deeds usually represent properties that are undesirable and have been passed over for several years. Of course, that is a generalization. You may find a few specks of gold dust, but your time is really more valuable.

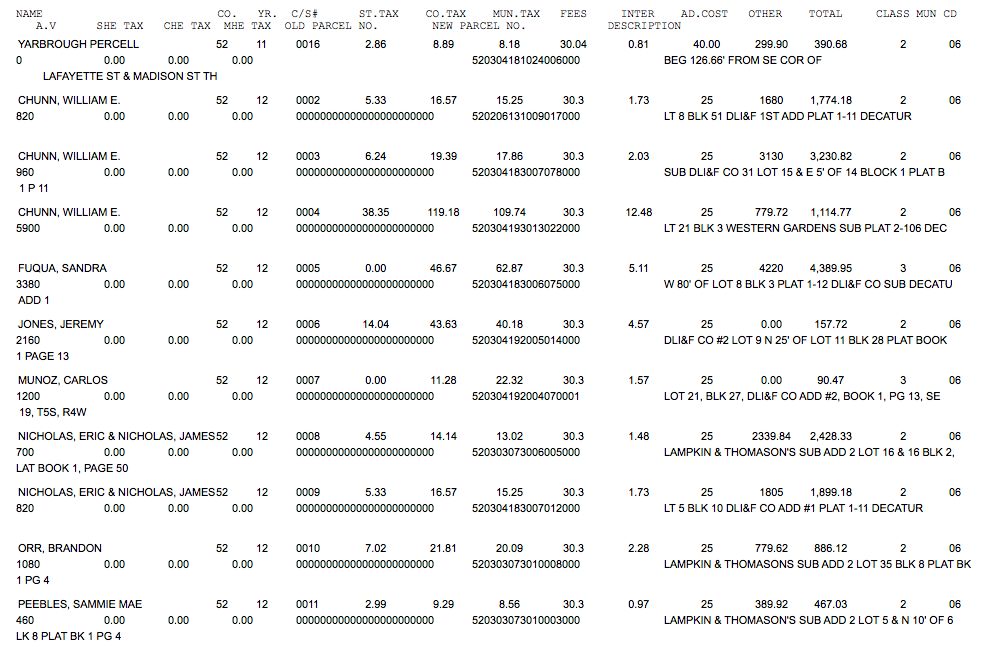

So, let's look further down the list to newer liens.

While we are screening the list for age, also look for a few other things. For example, in the description you will see "Beg 126.66' from" or "W 80' of Lot 8 Blk3." Be careful here. These descriptions may indicate an irregularly shaped lot. Oftentimes, these lots can't be built on because they are too small or the shape won't allow for a house. If you are interested, be sure to look these up with the County.

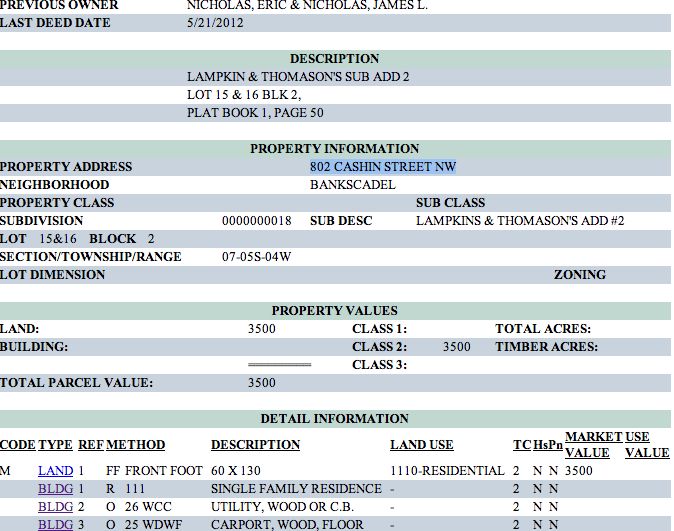

Using this small list, my attention is directed to the more expensive properties in hopes that they have residential properties or some inherent value. The first propety I looked at was Nicholas, Eric and Nicholas, James Parcel ID 52 (don't use the 52 in the property search) 03-03-07-3-006-005-000. To look up this and other properties, visit the main County Website by using either NACO.org or typing a search in your favorite search engine, such as Morgan County Alabama Website.

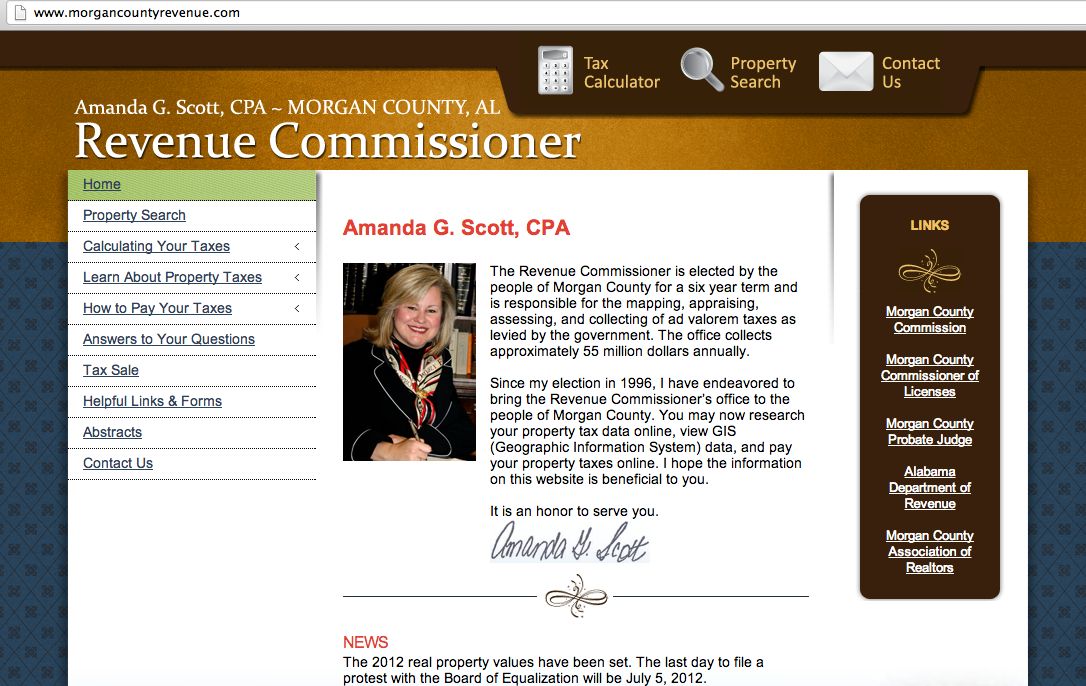

Step 4: Research - Tax Collector/Revenue Commissioner

Once on the site, find the Revenue Commissioner

Now, go to the property search and use either a name or the Parcel ID.

When you type this in you will see that the owner is the State of Alabama, which is why they are called Sold to State.

What can you see from this? Well, it is land with three buildings. The land is a small lot "60 feet by 130 feet." It is also residential. What concerns me is that the County does not show a value for the building(s). However, when you click on the building links, you will see more information, including a value. I am concerned enough about this "weird" discrepancy that I would call the County before making an offer.

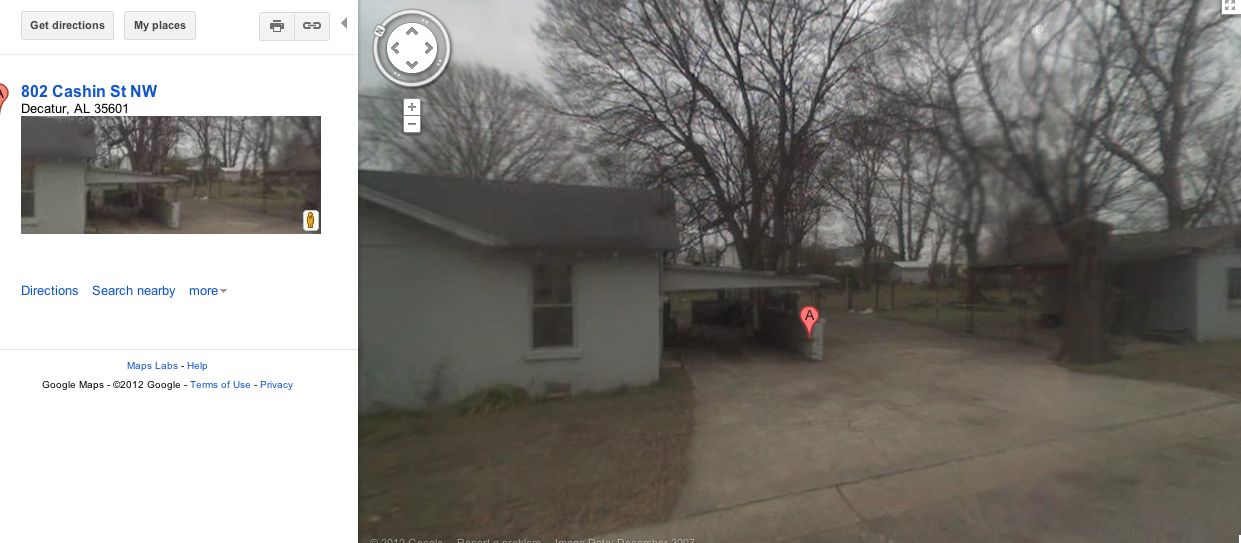

Step 5: More Research - Google Maps/Street View

Out of curiosity, let's use Google Maps and see what we find. Using the property address shown above, type in the address and include "Decatur Alabama" in Google Maps. This is what I found. Now, even though I'm showing you this, please be careful. Google Maps is not perfect. Again, I would call the County to verify that the building still exist and you are not just purchasing land.

Step 6: Due Diligence

Are there any other liens or issues?

Try this link: http://www.morgancountyprobate.com/DesktopDefault.aspx?tabindex=5&tabid=99 and search by name. Now, remember that the owner is the State of Alabama, but you will still search the previous owner's name because they can redeem the lien.

Step 7: Purchase

Now that you have done your research, contact the State of Alabama when you are ready to purchase. OTC liens and deeds are purchased on a first-come first-serve basis. So, you do not have to bid the interest rate down and in the case of deeds (older than 3 years), you do not have bid up the value of the property.

Use this link to download the application form:

http://www.revenue.alabama.gov/advalorem/forms/ADV-LD-2%20(8-11)%20.pdf

Step 8: Homework

Try this research on the rest of the 2012 liens on this list and in another County in Alabama and see what you come up with.

All the best,

Michael

|