March 1, 2013

Texas

Tax Deed Sales - Featuring Houston, TX

Dear Premium Members,

Well, it is almost Spring, except for the 20 inches of snow piled up around me. Hopefully that will melt sometime soon.

It's also the start of another

Washington, D.C. debacle, lovingly referred to as the sequester. Starting

today (March 1, 2013), automatic spending cuts go into effect because

Democrats and Republicans couldn't agree on a budget. It's really

pathetic, whatever your political views are.

Anyway, uncertainty just makes me happier to be a tax lien and tax deed

investor. Tax liens and deeds don't trade on a daily basis so they

don't fluctuate up and down.

This month I

decided to focus on Texas. In fact, I had a request to profile Houston,

Texas. Texas is huge, if you haven't noticed. The State ranks number 2

in size and number 2 in population. Alaska is larger in size and

California has more people.

Not only is Texas big, but its economy is significant. As of 2010,

Texas had a gross state product (GSP) of $1.207 trillion, the second

highest in the U.S. Its GSP is comparable to the GDP of India or

Canada, which are the world's 12th- and 11th-largest economies,

respectively (Wikipedia, 2013).

And even during the latest devastating recession, Texas remained one of

the few "shining stars." In 2012, when the U.S. unemployment rate was

about 8%, Texas' unemployment rate was 6.5%.

Texas has an amazing 254 counties. Just look at the map. If you can't

find a favorite county in Texas, then really there's no hope for you!

The largest city in Texas is Houston, which ranks fourth largest in the

U.S. Houston is located in Harris County, which has a population of

over 4 million people.

http://www.naco.org/Counties/Pages/FindACounty.aspx

Let's review how tax sales work in Texas.

When are tax sales held?

The first Tuesday of each month, as long as there are enough

properties. In some smaller counties sales may be held every other

month or quarterly.

Is Texas a tax lien or tax deed state?

Neither. It is a "deed with right of redemption" state. That means it

is somewhere inbetween. In Texas, you purchase a deed, but the previous

owner or interested party (e.g., bank), has a period of time to redeem

and buy back the deed. The redemption period is 6 months for

non-homestead and non-agriculture properties; it is 2 years for

homesteads or ag properties.

What happens if the previous owner redeems?

They have to pay a hefty fee of 25% within 6 months or 50% within two

years, depending upon the property classification, as described above.

What happens if they don't redeem?

You own the property, so do your homework before the tax sale.

How do you find Texas tax deed properties?

Search for a county using a favorite search engine or Naco.org. Once

you find the County's website, look for the Tax Assessor-Collector's

office. Several counties in Texas make use of law firms to handle their

sales. For Harris County sales, Linebarger, Goggan, Blair and Sampson,

LLP is the chosen firm. Boy, I hope they don't invite any more

partners, I can barely remember that name. Anyway, I can remember their

website, which is:

http://www.publicans.com.

Do you have to register in advance?

Do you have to register in advance?

Yes. Most counties require you to fill out a form in advance stating

that you do not owe any taxes in that county. The county will check to

make sure that you don't owe any taxes. This registration process is

usually good for 60 to 90 days. In Harris County, you can do this on

the day of the sale, but it must be done before a deed can be released.

The cost is $10.

Does Texas have online auctions?

Unfortunately, no. However, Harris County allows an agent to represent

you. Therefore, you can sign over a limited power of attorney to

someone you trust and they can act as your agent and purchase for you.

How do the auctions work?

Auctions start at the minimum bid and are bid upward. The winning

bidder pays the most for the property. If a property is redeemed, you

do not lose your overbid. It will be returned along with the 25% on top

of the entire winning amount.

For example, if bidding starts at $4,000 on a $75,000 house and you win

the property with a final bid amount of $40,000, then if the property

owner redeems, you will receive your $40,000 back plus 25% interest

($10,000) for a total of $50,000. If, on the other hand, the previous

owner never redeems, you bought a house valued at $75,000 for only

$40,000. Selling it at a wholesale price of $60,000 and assuming

realtor fees and fix-up costs of $10,000 would result in a net profit

of $10,000.

These are hypothetical examples, but it shows how the process works. It

also shows that there is a balance between overbidding to earn more

interest, but not too much in case the owner never redeems. You can

earn great returns either way, but please be careful on

overbidding. Let someone else learn a hard lesson. In the absence of

any information, you should

assume that the owner will not redeem. Remember, there are over 200 counties in Texas, and many have sales each month. The point is you have time.

What can you do to a house during the redemption period?

Do not make any major improvements. Do not add granite counter tops and

tile floors. Why? You will likely not be refunded the cost of any

improvements. You can, however, make repairs that are necessary to keep

up the property. An example would be repairing a leaking roof. This has

to be done to maintain the value of the property. Any improvement

should be immediately filed with the county. It will become part of the

redemption amount. It is always best to check ahead of time with the county and/or an attorney.

Now, let's look at the Harris County list.

Step 1: Go to Publicans.com, find the Tax Sale engine and search for

Tax Sales in Harris County. First, you will see the Precinct Number.

Note that Harris County has several precincts. There are eight (8)

Constables responsible for their own precincts, so you will see 8

precincts listed.

Tax sales are held the first Tuesday of each month at the Family Law

Center at 1115 Congress. Registration of bidders begins at 8:30 a.m.

Sales must be held from 10:00 a.m. – 4:00 p.m. Each of the Constables

conducts sales of properties in their precinct and the sales are most

often held simultaneously.

Tax sale procedures for Harris County are listed here:

http://www.hctax.net/Property/taxsalesprocedures/Default.aspx

Register online for the sale here:

http://www.hctax.net/Property/salesportfolio/bidders/default.asp

The entire list is over 100 pages; therefore, I took the properties and

copied them in Excel format with tabs for each precinct. The file is

located here:

http://www.rogueinvestor.com/premium13/lists/HarrisCo_TaxSale_List_March2013.xlsx

A subset (Precinct 5) is shown here:

http://www.rogueinvestor.com/premium13/lists/HarrisP5_March2013.pdf

SCREENING STEP NUMBER 1

Any property that shows CANCELLED means that the owner has redeemed or

paid his taxes, a bank has redeemed on behalf of the owner to protect

its interest, or another legal procedure has stopped the sale. For

example, bankruptcy can be used to stop a sale. These properties are no

longer for sale, so please don't waste your time.

SCREENING STEP NUMBER 2

SCREENING STEP NUMBER 2

Find a list of properties that interests you. Make sure the estimated minimum bid is well below the adjudged value.

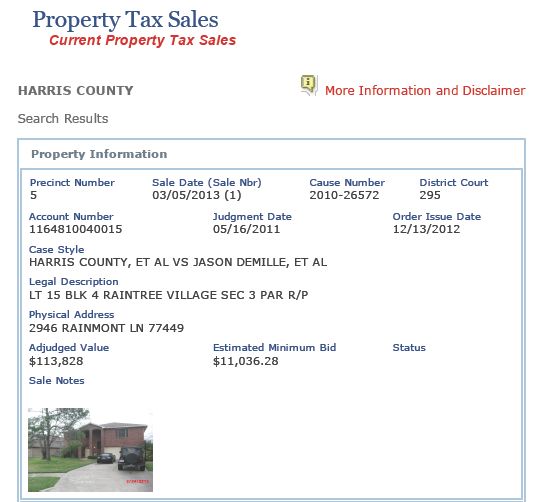

Here is a property that I found interesting:

The information shown includes the upcoming sale date, the date of the

judgment, the case type, the account number of the property, the legal

description, physical address, minimum bid and value.

What's missing?

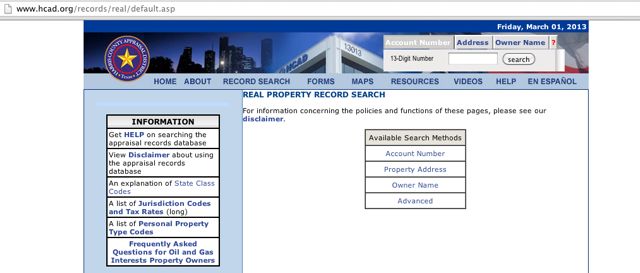

Well, I would like to know more about the property. Searching on the

Harris County website in the Tax Collector-Assessor's office, I found

that the appraisal information is located at:

http://hcad.org.

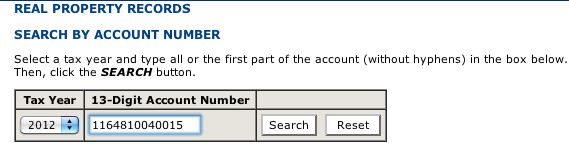

Using the property's 13-digit Account Number, you can search and find out more about the property.

As you can see below, the land and improvement values are shown. If no

improvement value is shown, then the property is only land. Listed

below you can see the date the house was built, its size and some other

important information, such as the condition and the fact that it has

no basement (slab grade), which is common in Houston. Note that the

quality of the house is average.

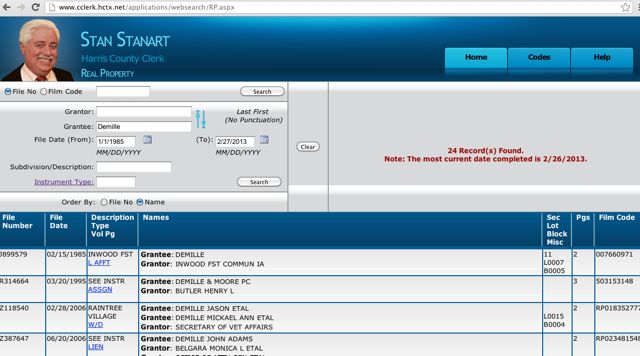

Okay, now let's take it a step further and see if Jason Demille has any

other serious liens filed against him, as it relates to the property.

To do this, you will need to visit the County Clerk's website and use

the Grantor/Grantee index. You will be searching by name as that is how

liens and judgments are filed. They are not filed by property.

Search under both Grantor and Grantee. You can see below that Mr.

Demille purchased the property in 2006. He is the Grantee of a Waranty

Deed from the Veteran's Administration. If he used a mortgage, then he

would be the Grantor of a Mortgage. Remember, in the case of Texas tax deed

sales, you do not have to worry about a mortage. It would be wiped away

if the bank does not redeem.

I did not see any serious liens, such as IRS liens. Remember, you are

looking for government liens, not private liens. Private liens, such as

mortgages, will be extinguished.

Now, using these procedures, go through some more properties and get

ready for the sale; or follow this sale and see what happens, then try

it next time.

Happy Tax Deed Hunting,

Michael Williams

michael@rogueinvestor.com

913-777-9779 - Office