Kern County, California

Research Teleseminar

STEP 1:

Research on County Website

Kern

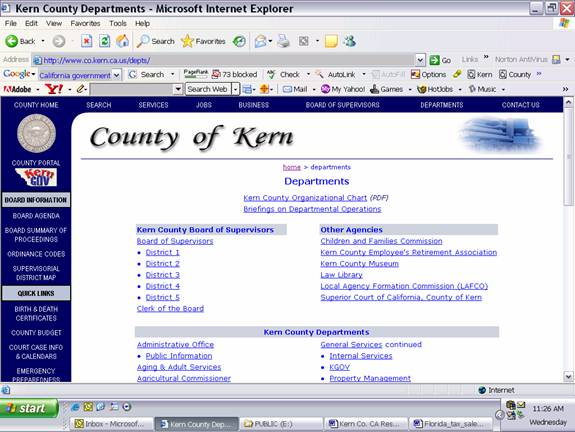

County Homepage

Go

to

www.co.kern.ca.us

Click on “Department” in the blue bar at

the top of the page.

Scroll

down and click on “Treasurer/Tax

Collector”

http://www.co.kern.ca.us/depts/

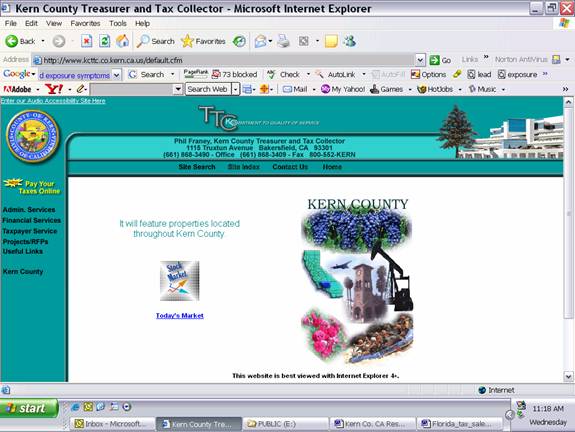

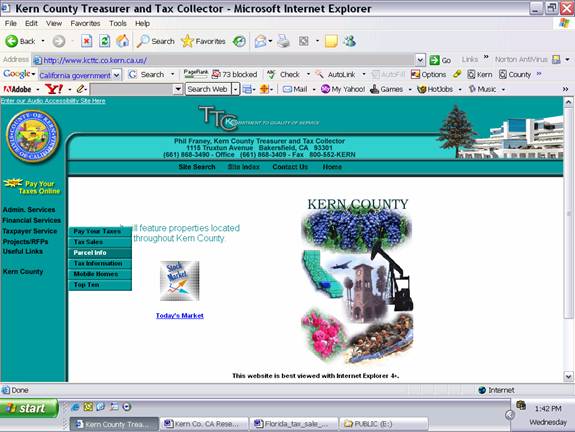

You will be redirected to the Kern

County Treasurer and Tax Collector

http://www.kcttc.co.kern.ca.us/

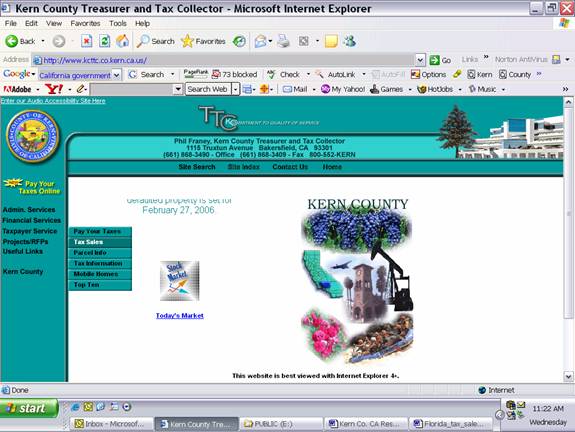

Click on

“Taxpayer Service” on the left margin,

then click on “Tax Sales” from the

pop-up menu to get to the Tax Sales web

page.

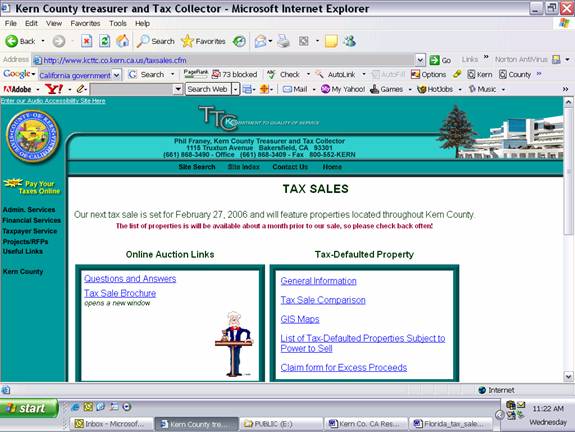

You will

be redirected to the Tax Sales web page.

http://www.kcttc.co.kern.ca.us/taxsales.cfm

This web page

contains the links to topics related to

the February 27, 2006 online tax sale.

You can click on any of the blue

underlined links you want to look at.

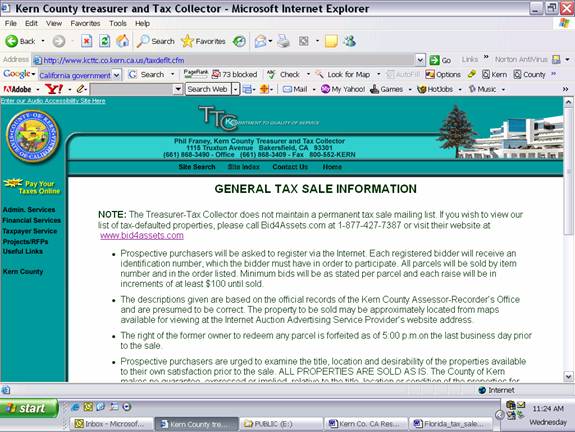

Clicked on

“Tax Sales Information”

http://www.kcttc.co.kern.ca.us/taxdeflt.cfm

This web

page presents general tax sale

information.

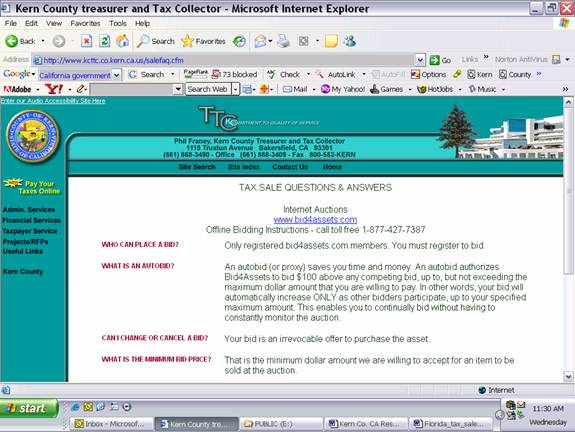

Clicked on

“Tax Sale FAQ”

http://www.kcttc.co.kern.ca.us/salefaq.cfm

This web

page contains answers to frequently

asked tax sale questions.

Clicked on

“Tax Sale Brochure”

http://www.kcttc.co.kern.ca.us/taxsalefaq.pdf

This

brochure contains information regarding

Kern County Tax Defaulted Land Sales.

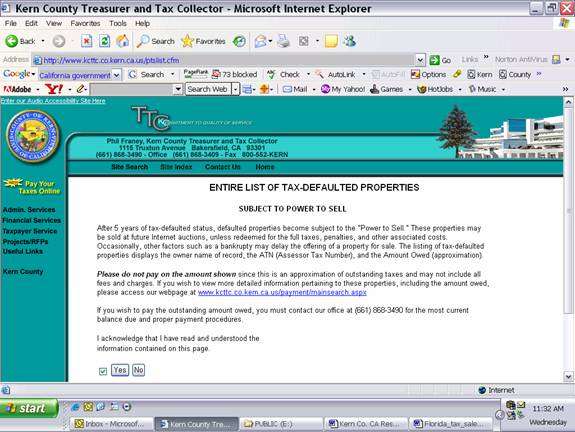

List of Tax-Defaulted Properties

http://www.kcttc.co.kern.ca.us/ptslist.cfm

You must

check the box next to the “Yes” button,

then click on the “Yes” button to

advance to the list.

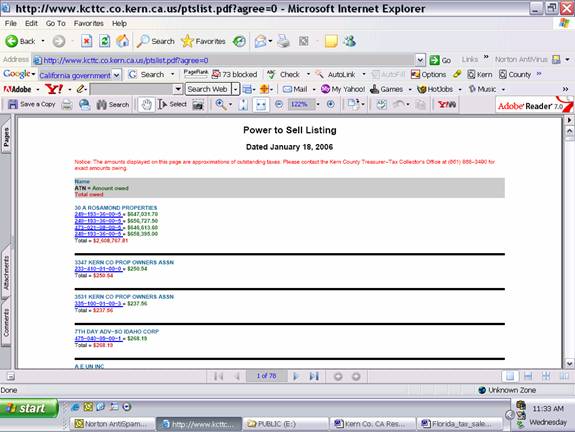

You are

then redirected to the Power to Sell

Listing. This is the tax sale list for

the Kern County sale as of January 18,

2006. It is updated frequently. As you

perform your research, it is recommended

that you consult the list frequently to

determine what properties have been

redeemed. That way you do not waste

your time researching properties that

will not be in the sale.

http://www.kcttc.co.kern.ca.us/ptslist.pdf?agree=0

Scroll

through the list using the bar on the

right margin. You can click on the blue

underlined ATN (Assessor Tax Number)

that will take you directly to the Kern

County GIS Maps. However, this is

probably not the best method for viewing

the GIS Maps.

Hot tip

for screening the list: Define your

investment objectives and the amount of

capital you can spend at the sale. Most

of the properties in the sale will be

land. One quick screen is to separate

parcels with improvements from the rest

of the list. Another quick screen is to

separate commercial properties from the

rest of the list.

Parcel

Information (linked to Assessor)

Click on

“Taxpayer Service”, then “Parcel Info”

from the pop-up menu to get to the

Treasurer’s web page for the link to

parcel information. All properties on

the tax sale list are referenced by the

parcel number.

You will

be redirected to the following page.

http://www.kcttc.co.kern.ca.us/parcel.cfm

Click on “Online Parcel Maps”.

You will

be redirected to the Kern County

Assessor’s Property Search web page as

shown on the following screen.

http://www.assessor.co.kern.ca.us/kips/property_search.asp

Select ATN

in the “Search Type” box. Then enter

the ATN as listed in Property List for

the property you are interested in. You

can also search by address, Assessor

Parcel Number (APN), or File Number.

Note: Do

not use hyphens when entering the ATN.

(We have

selected an example parcel: ATN is

230-200-62-00-5; therefore, you will

enter 23020062005)

Then click

on the “Search” button.

http://www.assessor.co.kern.ca.us/kips/property_values.asp?atn=23020062005

Use your

cursor to scroll up and down through

this page to view.

Information you can get from this

screen:

Parcel

number

Legal

description

Land size

Property

Use Code and description

Assessed

Value

Tax Bill

Information

Print this

page if you desire. You can click on

“View Parcel Map”, “Parcel History”, and

“GIS Map” to be directed to these items.

Clicked on “View Parcel Map”. A new

window will open to the parcel map on

which the subject property is located.

(No URL available)

Our

example parcel is the second from the

top on the far left side of the map.

You can save or print this map for your

use as desired.

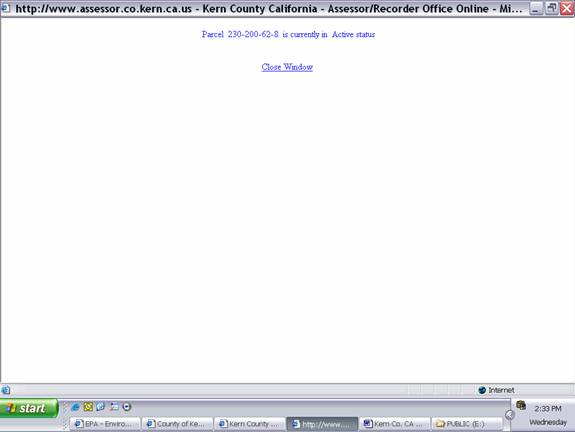

Clicked on “Parcel History”. A new

window will open. (No URL available)

The text

states that the example parcel is in

active status.

Clicked on

“GIS Map”. You will be redirected to a

new webpage.

http://206.169.45.184/imf/imf.jsp?site=krn_pro&qlyr=

Assessment+Parcels&qzoom=true&qbuf=250&qhlt=true&qry=

Kern.KERN.ParcelData_Full.ATN%3D%2723020062005%27

Please

note that you cannot use BACK button to

get out. You will need to experiment

with selecting the layers for items you

wish to be displayed on the map and

zooming in and out for different views.

Example of

view zoomed out 2x

Example of

view zoomed out several times

Note:

Edwards AFB south of site.

Search for

Liens and Other Documents. Your goal is

to determine if there are any recorded

liens or other issues with the title.

WARNING:

State of California Tax Sales DO NOT

erase municipal liens, state liens, or

federal liens.

Kern

County Recorder’s Office home page

http://www.assessor.co.kern.ca.us/

Click on “Official

Documents” in the left margin. You

will be redirected to the following

screen where you can select your search

type:

Grantor/Grantee

Document Number

Document Date

Document Class

Assessor Parcel

Number

Click on “Search Type”

We will use

Grantor/Grantee search for the example

parcel.

(No URL available)

Click on

“Grantor/Grantee” and you will be

redirected to the following screen where

you enter your search parameters.

From our

earlier research, we will use the

subject property’s owner of record,

Robert B. Hill. Enter last name first,

then click on “Search by Name”.

(No URL

available)

You can

also select to search by name within a

date range.

Your are

then redirected to the Recorder’s Office

Search Results.

(No URL

available)

Your

search results will be displayed. We

will click on the first listed name,

“Hill Robert B” because this exactly

matches the subject property owner’s

name.

(No URL

available)

The search results include deeds, deeds

of trust, reconveyance, and other

documents related to the subject

property. You can click on the

underlined Document Number corresponding

to the description you would like to

review.

For this example, we have selected the

first document on the list – Notice of

Power to Sell Tax Defaulted Property.

This confirms that the subject property

is in tax default status.

(No URL

available)

Excess

Proceeds Claim Form

http://www.kcttc.co.kern.ca.us/CLAIM%20FOR%20EXCESS%20PROCEEDS.pdf

This form

is used to claim excess proceeds from

tax deeded land sales. This form is to

be used by delinquent taxpayers to

recover money that exceeds the minimum

bid (i.e., taxes, penalties, and

interest owed).

Next Step: Use

Google Map As Another Way to Lookup

Property Location

|